Real Reform’s 2022 Bipartisan Insurance Reform Agenda

By Eric Holl, Executive Director

Louisiana is in an insurance crisis. The legislature ignored the cries of victims of Hurricanes Laura and Delta and refused to pass significant insurance reform in the 2021 legislative session. Just a few months later another Category 5 storm, Hurricane Ida, struck our state. Now the people of Southeast Louisiana are languishing in the same insurance purgatory that Southwest Louisiana families have been stuck in for 18 months.

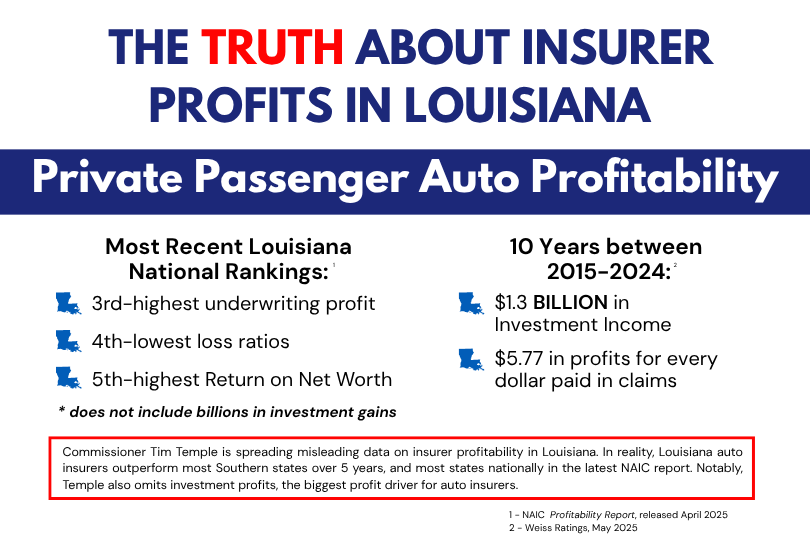

To make matters worse, the 2020 tort reform legislation that the insurance commissioner and corporate lobbyists promised would lower auto insurance rates by 25% has proven to be an abysmal failure. Instead of going down, our auto insurance rates have skyrocketed 19%, and Louisiana has become the most expensive state in the country for auto insurance.

Luckily, it is not too late to fix our broken insurance system and end the abuse of policyholders. Strong, meaningful insurance reform legislation has been introduced by a bipartisan group of legislators. All of it is commonsense legislation focused on creating transparency in the claims process, making insurance companies play by the rules, and increasing penalties on bad actors. Any insurance company currently conducting their business with decency and respect will be minimally impacted by this proposed legislation.

See below for a statement from Real Reform Louisiana Executive Director Eric Holl, followed by the full list of legislation Real Reform Louisiana is supporting and opposing as filed.

“We would like to thank Sen. Jeremy Stine, Rep. Ed Larvadain, Rep. Matthew Willard, Rep. Tanner Magee, Rep. Kyle Green, Rep. Edmond Jordan, Sen. Jay Luneau and the many other legislators who are standing up and fighting for policyholders. We would also like to thank Governor Edwards for including insurance reform in his legislative package. Thanks to this bipartisan group of leaders, Louisiana may finally get the insurance reform our people desperately need. The people of Louisiana are watching, and Real Reform Louisiana will be informing the public of how their legislators vote on this crucial legislation.”

SUPPORTED LEGISLATION:

Property Claims

- SB208 (Stine) — Increased penalties for bad actors. The main incentive insurance companies have to not cheat their policyholders—besides basic decency—is the threat of bad faith penalties that can be awarded if a court of law finds that the insurance company wasn’t following the law or their contract. Theoretically, bad faith penalties are supposed to be the deterrent that stops bad behavior by insurance companies. Clearly, the current penalties we have aren’t working, and must be strengthened. This legislation would do so. It would also add further increased penalties if an insurer is operating in bad faith and dragging out a claim for an extended period of time, in an effort to end the endless delay tactics insurance companies use to exhaust and frustrate hurricane victims. [Note: Similar legislation is expected to be filed in the House by Rep. Ed Larvadain, which Real Reform will also support]

- HB268 (Magee) and HB558 (Willard) — End insurance purgatory. Right now, insurance companies are required to pay claims shortly after receiving ”satisfactory proof of loss.” Unfortunately, insurance companies abuse that legal language, arbitrarily insisting they haven’t received “satisfactory proof of loss” for months on end in order to drag out claims and wear down desperate hurricane victims. These bills would limit the amount of time insurance companies have to obtain “satisfactory proof of loss” to stop the endless delays and end insurance purgatory.

- HB316 (Willard) and SB331 (Stine) — Claims transparency. Despite laws currently in place that entitle policyholders to their insurance policy and information on their claim, many policyholders report that their insurance company refuses to provide documents. This legislation would solve that by requiring insurance companies to proactively provide policyholders with claims materials they are already entitled to, so that the policyholder can understand their claim and advocate for themselves.

- HB692 (Larvadain) — Enforce the fraud laws we already have on the books. If laws are being violated by insurance companies, engineers, contractors, or anyone else after a storm, there needs to be investigation and enforcement. Unfortunately right now, there seems to be no law enforcement entity who considers it their responsibility to investigate potential fraud committed in the insurance claims process after a storm, especially if that fraud is committed by the insurance company or one of their representatives. This legislation would create a task force modeled after the Louisiana Automobile Theft and Insurance Fraud Prevention Authority that already exists in state government, focused on enforcing fraud laws against bad actors after named storms.

- HB317 (Willard) and SB150 (Luneau) — No more surprise deductibles. Many homeowners who file a claim after a hurricane say they were unaware that they had a ‘named storm deductible,’ which can be so high it renders their insurance policy useless. This legislation is modeled after current law on uninsured motorist policies in auto insurance. It would require policyholders to provide affirmative consent—like a signed form—agreeing to their named storm deductible before it can take effect as part of their policy. This will help consumers be better informed when purchasing their policy, and help insurance companies and agents avoid confusion and disputes over named storm deductibles when claims are filed.

- HB682 (Brown) and SB330 (Stine) — Adjuster registry. Many policyholders place their trust in the adjuster sent by the insurance company to begin adjusting their claim, only to find out later that that adjuster was inexperienced or unqualified. This bill would create a database of registered insurance adjusters that is easily accessible and digestible to policyholders, so that when the insurance company sends an adjuster to someone’s house, they can look them up and see if they are registered and qualified for the job.

- HB805 (Green) and SB355 (Gary Smith) — Stop mortgage companies from arbitrarily withholding checks. Right now, there are no rules governing how mortgage companies disburse checks they receive from insurance claims. As a result, homeowners can be left in the lurch while their bank earns interest on insurance money and the policyholder misses out on contractors. This bill creates reasonable rules for mortgage companies when handling insurance checks.

- SB209 (Stine) and SB210 (Stine) — Increase the fines the insurance commissioner can levy against insurance companies who break the rules.

- SB13 (Bouie) and SB345 (Gary Smith) — Limit insurance companies to three adjusters to stop the endless adjuster churn so many policyholders deal with.

- HB83 (Schlegel) and SB134 (Talbot) — Require insurance companies to honor the sections of their policies that cover costs for evacuation, even if the evacuation is only suggested by local government leaders, and not mandatory.

- SB231 (Henry) — Make uninhabitable mean uninhabitable. This legislation would stop insurance companies from claiming that dangerous living conditions with long term lack of basic utilities do not make a dwelling "uninhabitable." After Hurricane Ida, Louisianans died because their insurance company would not pay for them to find a safe place to stay.

- SB253 (Barrow) — Makes it illegal for insurance companies to discriminate against elderly and developmentally disabled policyholders.

- HB621 (Green) — Gives more time for policyholders to complete repairs.

- SB105 (Fesi) — Requires insurers to give 30 days notice of changes to policies that will happen at renewal.

- SB119, SB163 (Talbot) and SB232 (Stine) — Creates a Catastrophe Claims Consumer Guide and Catastrophe Claims Disclosure Form that must be given to policyholders.

- SB198 (Talbot) — Gives a point of contact and info on dispute to policyholder after they’ve dealt with three adjusters.

- SB214 (Luneau) — Requires out-of-state adjusters to return to Louisiana to testify in case of a legal dispute.

- SB352 (Fields) — Requires utility providers to issue a credit to customers who experience an outage of service for more than 24 hours.

- HB703 (Miller) — Requires disputes about contracts for repairs to residential property during a hurricane to take place in parish the property is located in.

- HB788 (Romero) — Provides for an out-of-state contractor database.

Automotive Claims

- HB351 (Jordan) - Bans the use of ridiculous non-driving rate setting factors like education level, employment status, trade, business, occupation, profession, or credit information. Insurance companies use these ridiculous factors to overcharge good drivers and undercharge wealthier, upper class reckless drivers. This hurts the entire insurance market by reducing incentives to drive safely and causing good drivers who work blue collar jobs or have low credit scores to go uninsured or underinsured because they’re being overcharged.

- HB116 (R. Carter) – Stops insurance companies from passing on the costs of their ubiquitous advertising to policyholders in their insurance premiums. Drivers shouldn’t have to pay for the cost of all those unavoidable ads featuring Emus, Geckos, Mayhem, and Jake.

- HB290 (R. Carter) - Provides for a five percent insurance rate reduction for motor vehicles with a dashboard camera.

OPPOSED LEGISLATION:

Property Claims

- HB539 (Firment) – Weakens current legal protections in place to ensure policyholders get the replacements and repairs they are entitled to.

Automotive Claims

- SB128 (Talbot), SB120 (Talbot) and HB705 (Seabaugh) – Like 2020’s failed tort reform legislation, these bills would further rig the courts against policyholders in order to pad corporate profit margins. And like 2020’s failed tort reform legislation, these bills would do nothing to lower insurance rates. They would give insurance companies more ways to delay and deny claims like they are doing to tens of thousands of hurricane victims across South Louisiana.