2025 Legislative Primer.

The 2025 Louisiana Legislative Session begins Monday, April 14, 2025. Insurance is again at the forefront, but this time Commissioner Temple and his legislative allies are focused on auto insurance. Temple is touting a package of bills that promise to further stack the deck in favor of big insurance at the expense of Louisiana policyholders.

Here is an overview of Louisiana's insurance crisis and the industry's continued efforts to profit off of policyholders' pain.

Competitiveness

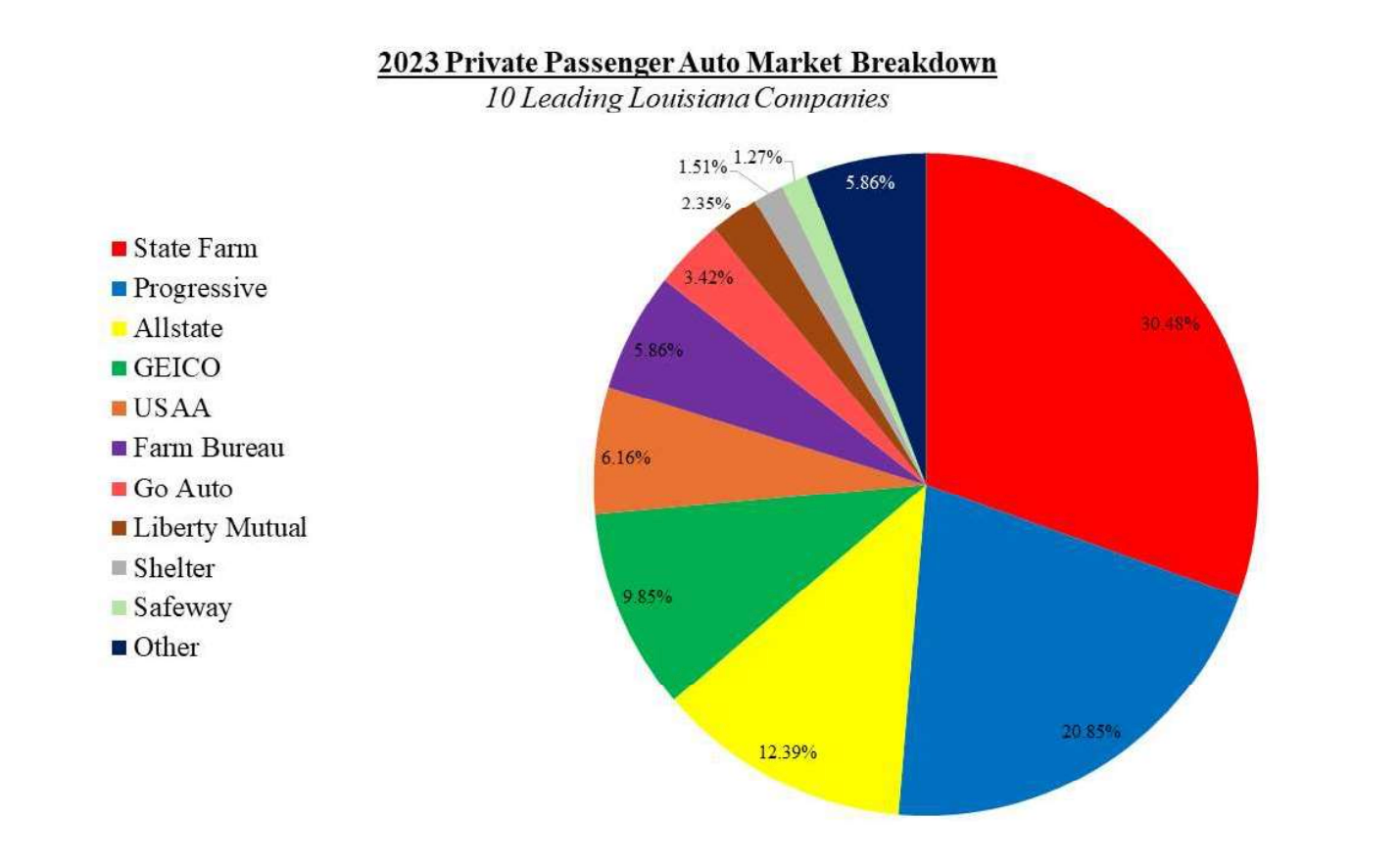

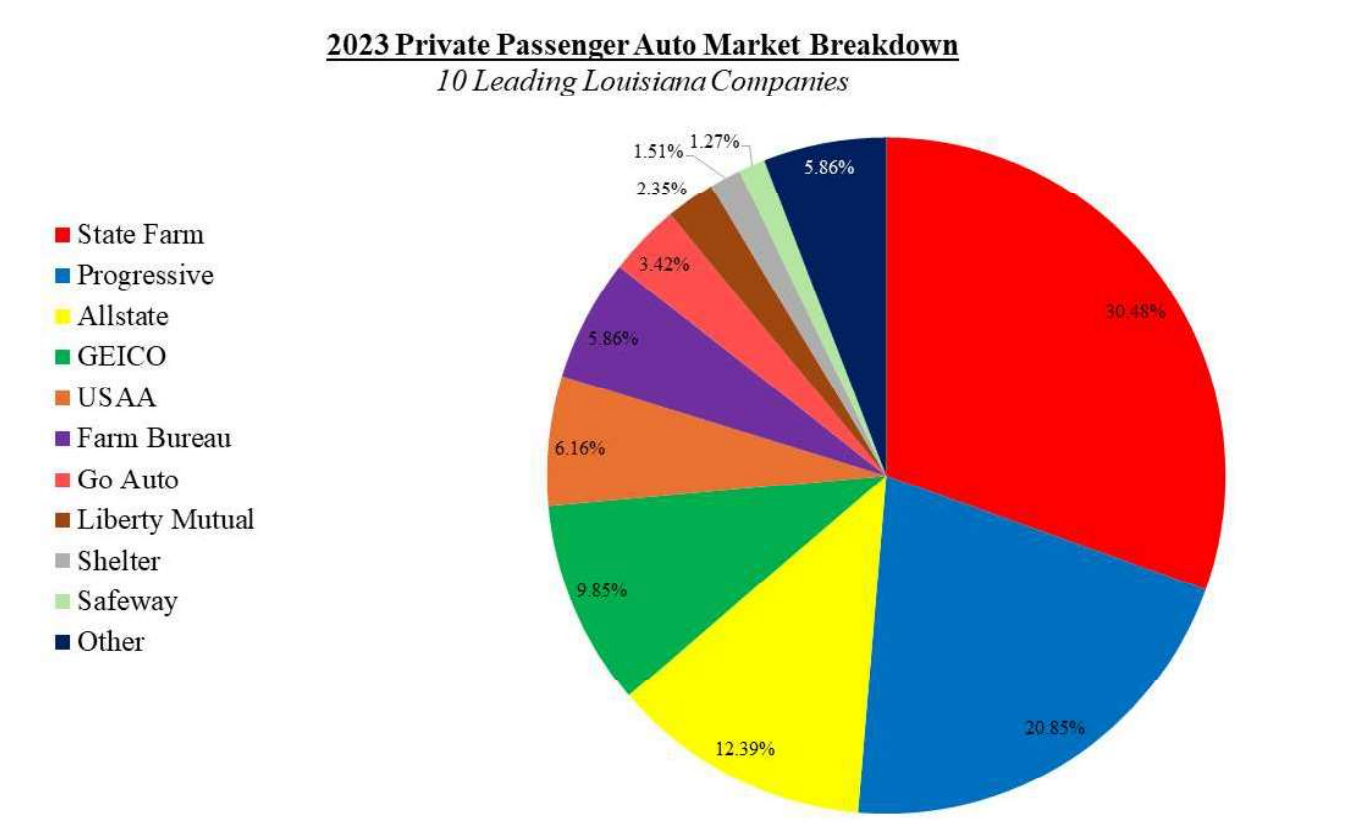

Commissioner Temple has repeatedly stated that Louisiana's insurance market is non-competitive. To attract more insurance companies to Louisiana, Temple wants to pass legislation that guts policyholders' rights and benefits insurers.

However, an industry expert and former Missouri Insurance Commissioner recently testified before the Louisiana legislature, stating that the structure and number of companies participating in Louisiana's personal auto insurance market "is squarely in the national mainstream."

Click here to read more about the competitiveness of Louisiana's auto insurance market.

Profitability

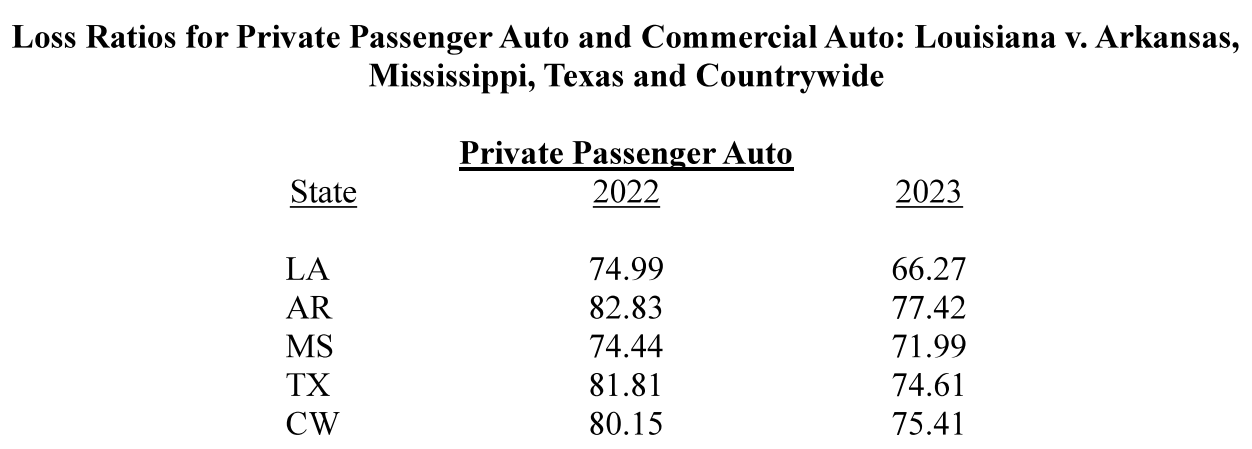

Commissioner Temple and his legislative allies have repeatedly suggested that insurers in Louisiana are struggling to turn a profit. However, the data suggests otherwise.

Insurers do not report their profits. Instead, they report loss ratios, which are proxies for profit. Loss ratios show the percentage of losses an insurance company pays out compared to the premiums it collects. The lower the ratio, the more the profit.

Louisiana personal auto insurance loss ratios were 9% better than the national average in 2023, and at least 5% better than each of our neighboring states: Arkansas, Mississippi, and Texas. These strong profit margins are largely driven by the fact that insurers in Louisiana collect among the highest premiums in the nation.

Click here to read more about the profitability of Louisiana's auto insurance market.

Why are rates so high if the market is competitive and insurers are making a profit?

According to expert testimony before the Louisiana legislature, high insurance rates in Louisiana are due to severe weather and industry-friendly lax regulations.

Louisiana law allows the commissioner to reject a rate for being too low, but it does not grant the commissioner sole authority to reject a rate for being excessive. In fact, Commissioner Temple testified that it is not the role of the Department of Insurance to determine whether rates are excessive.

According to testimony, some of the rates insurers filed with the Louisiana Department of Insurance included "really, really high" profit factors. Not surprising when you recall that Commissioner Temple repealed profit caps on rates filed by insurers with the State of Louisiana.

These findings are consistent with a Harvard School of Business report that found “higher [insurance] premiums are being charged in states where regulators apply less scrutiny to requests for rate increases.”

Click here to read more about how lax regulation contributes to high rates in Louisiana.

Why is Commissioner Temple and Big Insurance pushing Florida's failed model?

Florida has the highest property and auto insurance rates in the nation. Florida auto insurance rates have increased 42% since 2022, when the pro-industry package passed. Since the passage of these bills, we have seen:

- Pro-industry lawmakers in Florida seek to take advantage of the new laws, pushing a new insurance company, promising a 165% return on investment over 5 years.

- Insurers have exploited the lack of transparency and accountability. "As Florida insurance companies were going bankrupt, policies were getting dropped and homeowners were being left empty-handed, a new report says many of those companies were making billions."

- Buyer remorse: "Florida legislators have introduced bills that would amend state insurance laws," aimed "to enhance consumer protections while increasing regulatory oversight of insurance carriers operating in the state."

- The people of Florida will vote on "a newly proposed amendment to the State Constitution" that would "protect consumers from seeing their policies canceled."