Insurance Companies Caught Cheating Storm Victims

A shocking investigation by 60 Minutes exposes a widespread conspiracy by insurance companies to deceive and lowball storm victims. Licensed adjusters described it as a “deliberate scheme” committed by multiple insurance companies “over and over again” designed to mislead policyholders and reduce payouts.

Key allegations include:

- Altered damage reports to reduce payouts

- Deceptive tactics to misrepresent adjusters’ reports and conceal major changes by insurers

- Illegally omitting damage from assessments

- Systematic scheme to force policyholders into costly lawsuits

Insurers are effectively “playing the odds and winning”

The 60 Minutes exposé described a scheme designed to “make them make us pay” or, in other words, file a lawsuit. Insurance companies delay, deny, and lowball policyholders, knowing that people are reluctant to file a lawsuit. They are playing hardball with customers who have dutifully paid premiums for decades to reduce their payouts.

Insurance companies are weaponizing a crisis they created

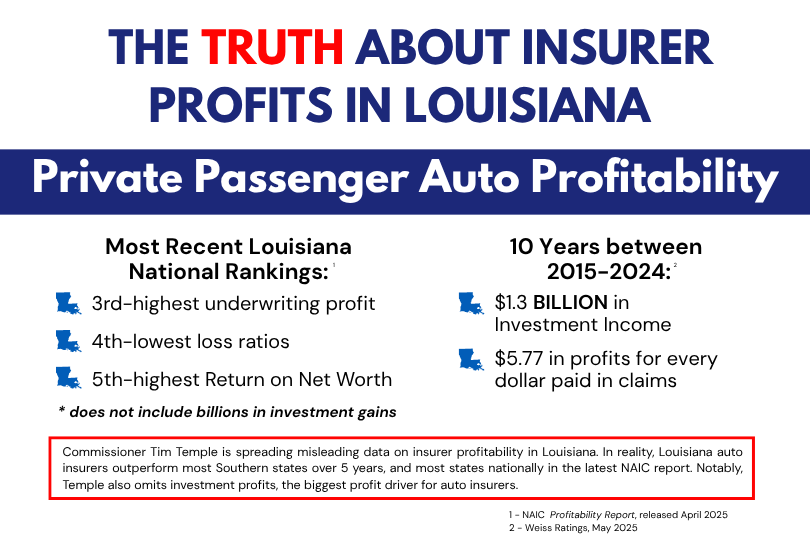

This deceptive strategy not only pads insurer profits but also results in a spike in litigation, which the industry uses as leverage in state legislatures to strip away policyholders’ legal rights. Insurers abandoned Louisiana homeowners after hurricanes Laura, Ida, Delta, and Zeta. As a result, there was a spike in lawsuits from cheated policyholders. Commissioner Tim Temple and the industry have cited increased litigated claims to gut consumer protections and make it harder to sue insurers.

Call to Action

The people of Louisiana have no reason to trust insurance companies. Insurance companies pocketed the premiums they collected for decades and deserted Louisiana policyholders after the storms of 2020 and 2021. Commissioner Tim Temple and our elected representatives in the legislature work for the people of Louisiana, not big insurance companies. We desperately need real insurance reforms that lower costs, increase transparency, and hold insurers accountable when they act in bad faith.

Watch the entire 60 Minutes story on insurers deceiving and shortchanging policyholders here.