Florida's failed model won't work in Louisiana.

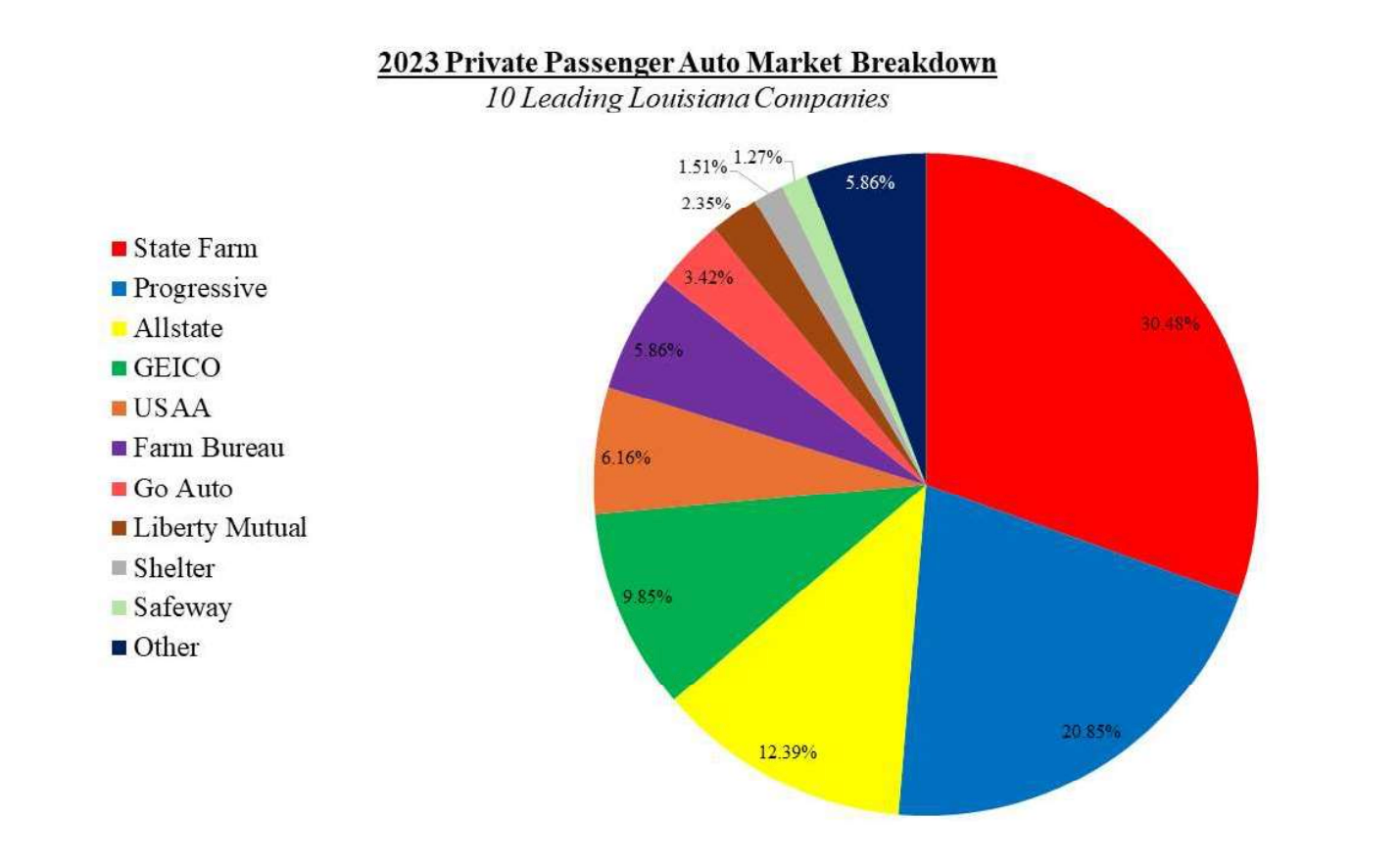

Louisiana's insurance crisis is crushing working families and small businesses. Property and auto insurance premiums are soaring while the Bayou State's loss ratios (a proxy for insurer profits) are among the best in the nation. Nevertheless, Commissioner Tim Temple, his allies in the legislature, and the insurance industry continue to push anti-consumer legislation that makes it harder for policyholders to file a claim with no promise of lowering rates.

Proponents of these bills that stack the deck further in favor of big insurance routinely cite the recent "reforms" enacted in Florida. So, let's set the record straight about Florida.

Florida's reforms failed

According to Insurance Business Magazine, insurers are seeking a 50% premium hike in Florida. Moreover, "Citizens Property Insurance Corp. is set to increase rates for most policyholders in Florida, despite recent statements from Gov. Ron DeSantis suggesting that the insurer would implement statewide premium decreases."

Florida lawmakers stacked the deck in favor big insurance, then asked to be dealt a hand at policyholder's expense

Immediately after passing the industry-friendly package, some Florida lawmakers began pitching "a proposal to invest in a new homeowners insurance company, according to a Miami Herald/Tampa Bay Times story. The pitch comes with an impressive projected return on investment of 165% over five years."

Insurers lied to lawmakers and policyholders, pocketing billions while claiming losses

Insurers exploited the lack of transparency and accountability. "As Florida insurance companies were going bankrupt, policies were getting dropped and homeowners were being left empty-handed, a new report says many of those companies were making billions."

Lawmakers looking to roll back failed reforms

Having realized their extreme reforms hurt policyholders, "Florida legislators have introduced bills that would amend state insurance laws," aimed "to enhance consumer protections while increasing regulatory oversight of insurance carriers operating in the state."

The people of Florida are fed up

The average home insurance policy is more than $8,000 higher in Florida than the national average. Unable to afford these unaffordable rates, Florida voters are looking to "take the power of lowering insurance premiums into their own hands." They will vote on "a newly proposed amendment to the State Constitution would also protect consumers from seeing their policies canceled."

Louisiana cannot afford to follow Florida's failed model

Louisianans are already paying more of their income on insurance than any other state. Working families and small businesses cannot afford to continue pursuing changes that benefit big insurance at their expense.