Big Insurance's Louisiana Boondoggle.

Former Missouri State Insurance Commissioner Jay Angoff recently testified before the Louisiana Senate Judiciary A Committee. The former commissioner reviewed data provided by insurance companies to the National Association of Insurance Commissioners (NAIC). The hearing and most of the data presented focused on personal and commercial auto insurance.

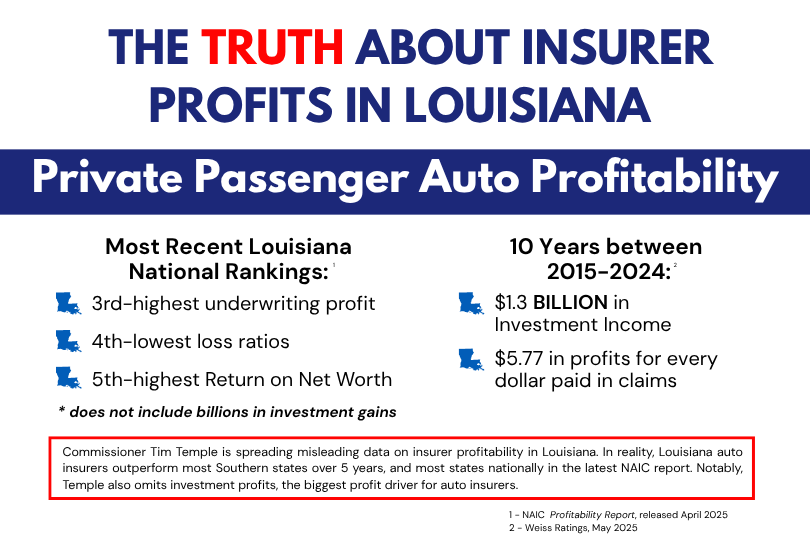

A key takeaway on personal auto from the NAIC data was that Louisiana's insurance market is competitive and profitable. This revelation was particularly interesting because it undercuts Commissioner Tim Temple's analysis of the Louisiana insurance market and his legislative agenda.

Commissioner Temple has repeatedly stated: "If we get more companies in Louisiana, then that helps solve issue number one which is availability. Once you have more companies in Louisiana, that helps work on problem number two which is affordability.”

Yet, the data presented by former Commissioner Angoff painted an entirely different picture.

Competition is not the issue.

For starters, while rates in Louisiana are among the highest in the nation, Mr. Angoff's report suggests that the structure and number of companies participating in Louisiana's personal auto insurance market "is squarely in the national mainstream."

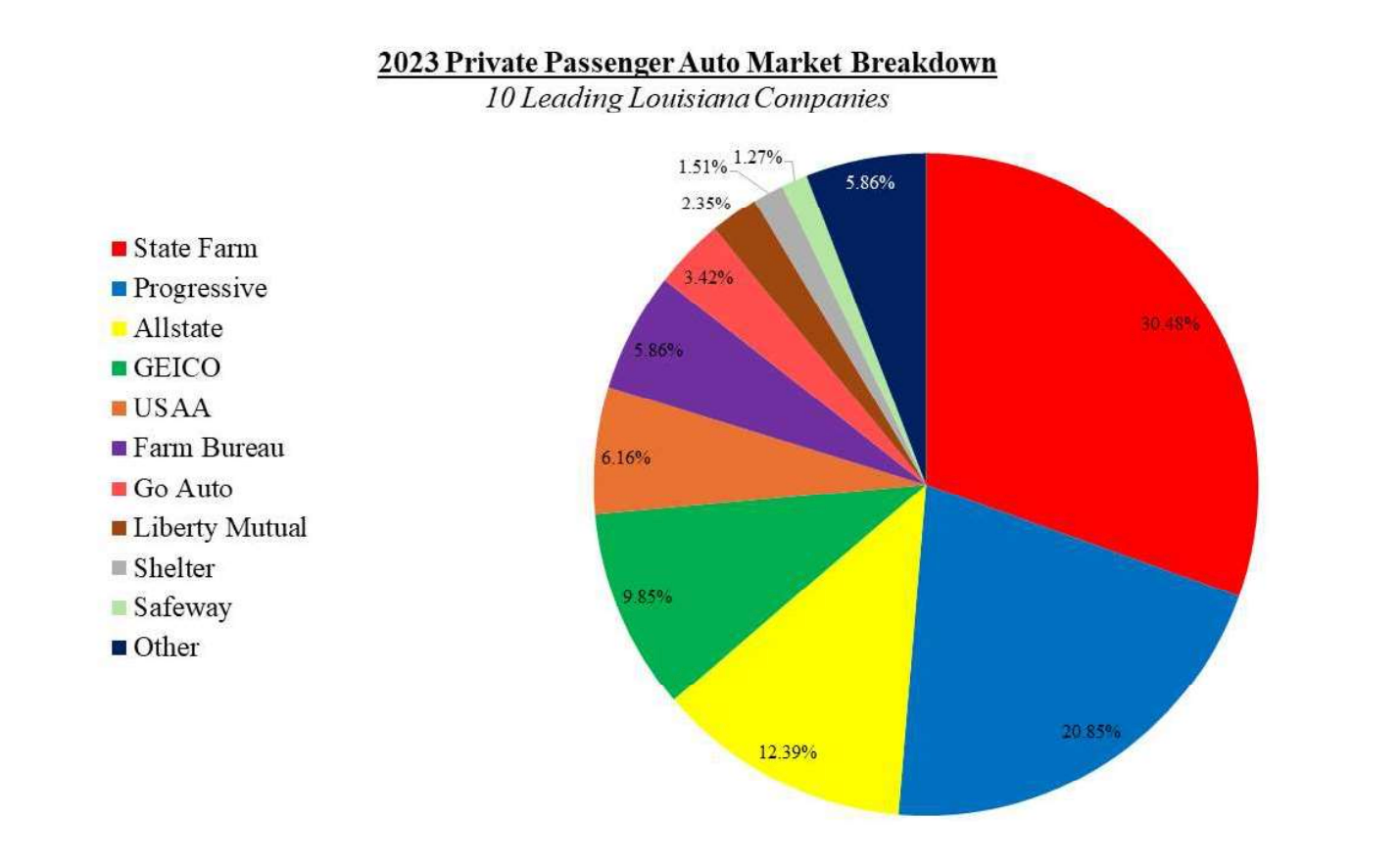

He goes on to say that "nationally and in all but three states, the four largest carriers have more than 50% of the personal auto insurance market. The four largest carriers nationally are State Farm, Progressive, GEICO and Allstate, and they account for the majority of the market both nationally and in 15 states, including Louisiana." In addition to the big four, there are 6 other insurers accounting for 94.14% of the market share with smaller companies comprising the remaining 5.86%.

Profitability is not the issue.

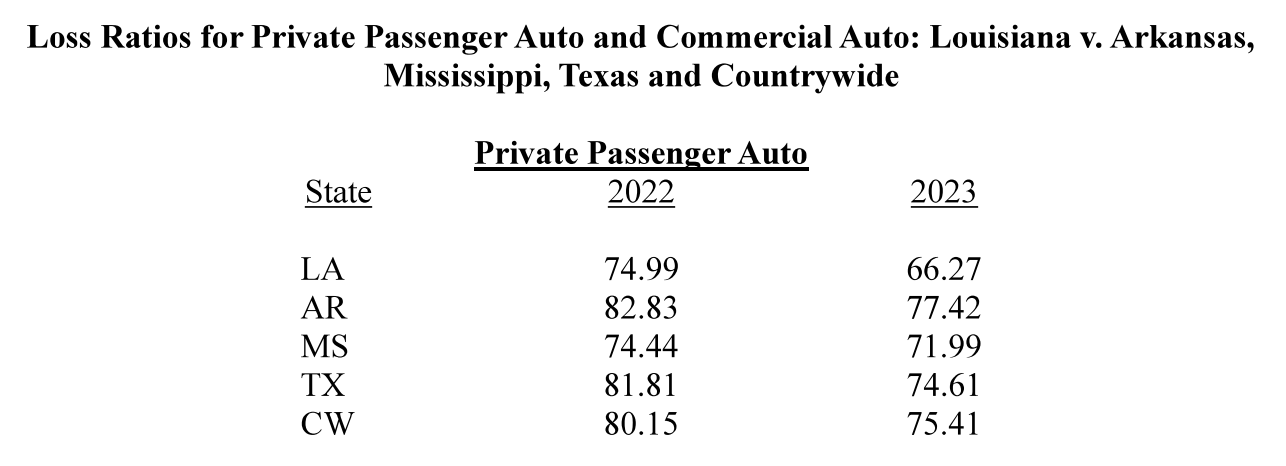

To put it simply, auto insurance is profitable in Louisiana. Mr. Angoff states in his report that "in addition to being lower than the countrywide average in both 2022 and 2023, the personal auto loss ratio was lower in Louisiana than in any of the three states bordering Louisiana in 2023, while in 2022 it was lower than it was in Arkansas and Texas, and ½ of a point higher than it was in Mississippi."

Insurers enjoy lower loss ratios but aren't passing savings onto policyholders.

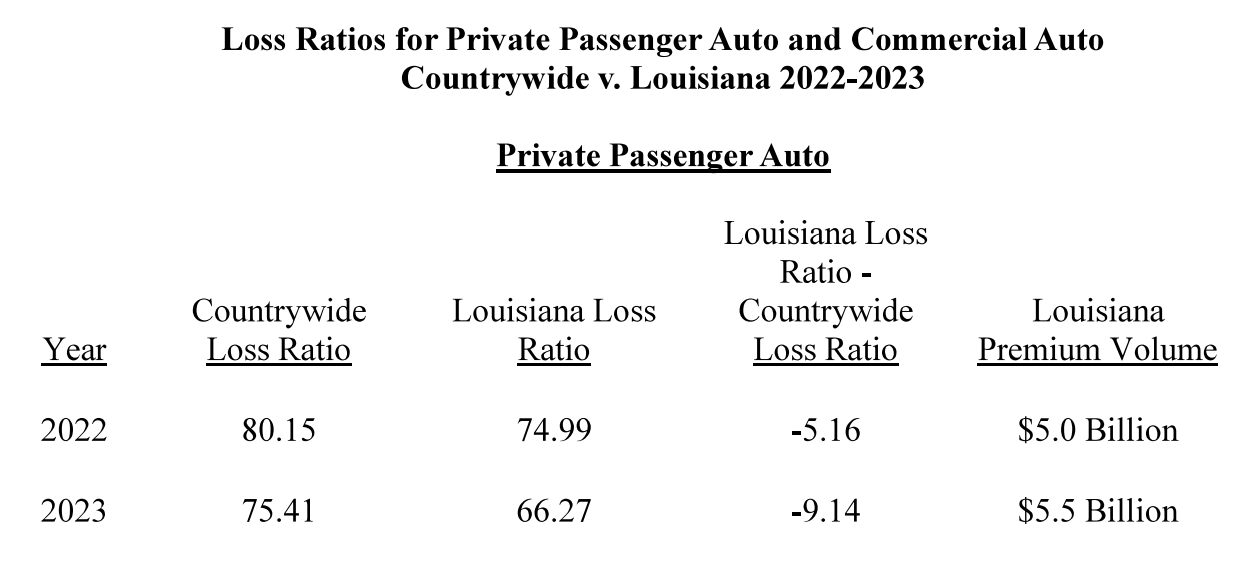

The report not only notes the low loss ratios in Louisiana, but the downward trend: "In 2023 the private passenger auto loss ratio dropped substantially—by almost five points countrywide, from 80.15 to 75.41. But the Louisiana private passenger auto loss ratio fell by even more: by 8.72 points, to 66.27. That 66.27 loss ratio was 9.14 points lower than the 75.41 countrywide average." Yet, auto insurance rates in Louisiana rose by 24% in Louisiana, according to Kiplinger.

Why are rates high? Because Louisiana allows insurers to charge excessive rates!

Jay Angoff explains that Louisiana law allows the commissioner to reject a rate for being too low, but does not grant the commissioner sole authority to reject a rate for being excessive. Mr. Angoff also explains that he found "really, really high" profit factors in rate filing he reviewed in Louisiana.

This is consistent with a Harvard School of Business report that found “higher [insurance] premiums are being charged in states where regulators apply less scrutiny to requests for rate increases.”

In fact, Commissioner Temple has said himself that he does not believe it is the Department of Insurance's role to tell insurers their rates are too high.