Blog Layout

Donelon’s Chief Actuary: “The regulator won’t necessarily know what the insurance company is doing or what goes into their models. Heck, we don’t even know half the models’ names.”

FOR IMMEDIATE RELEASE

February 26, 2020

Contact: info@realreformla.com

Yesterday, Consumer Reports magazine released a stunning report

exposing that car insurance companies use increasingly secretive and complex rate setting models to overcharge drivers and jack up profits, regardless of someone’s risk on the road. In the report, the Louisiana Department of Insurance admitted they had no way of knowing how insurers are forming rate-setting models, saying “heck, we don’t even know half the models’ names.”

The report was the results of a months-long investigation into a proposed car insurance rate setting scheme in Maryland. That scheme was mirrored around the country, sometimes without regulators even knowing.

In Maryland, where regulators were able to demand transparency and make documents public, it was exposed that Allstate intended to gouge a group of “suckers” by hiking their rates because an algorithm predicted those customers would tolerate the large rate increase. Not because their risk had increased. Not because their driving behavior had changed. But because Allstate predicted they could be squeezed for more money.

While those “suckers” were being charged extra, Allstate promised regulators they would cut rates for drivers they acknowledged were being overcharged. But when regulators demanded transparency, it turned out the discounts were practically non-existent, capped at 0.5% and often lower than that.

According to Consumer Reports and experts they spoke to these practices are also being used by other insurers and in other states—possibly in complete secrecy.

When Consumer Reports reached out to Louisiana Department of Insurance Chief Actuary Rich Piazza, he admitted that his department was largely in the dark on insurance rate setting models, saying: “they don’t lie; they just don’t tell you unless you ask the right set of questions. The regulator won’t necessarily know what the insurance company is doing or what goes into their models. Heck, we don’t even know half the models’ names.”

Recent reporting in Louisiana has exposed that insurance companies arbitrarily penalize returning military veterans and single women with higher rates, but this Consumer Reports article exposes the extent of insurance companies' unethical drive for more profits—and the inability of the Louisiana Department of Insurance to do their jobs and stop it.

See below for a statement from Real Reform Louisiana Executive Director Eric Holl in response to this shocking report:

“Your insurance rate should be based on your driving record—but insurance companies are arbitrarily gouging drivers to pad insurance company profits. Here in Louisiana, our insurance commissioner is asleep at the wheel, with his own experts admitting they don’t know how insurance companies set their rates. We need real insurance reform to stop the price gouging, bring transparency to rate-setting and lower rates.”

By Ben Riggs

•

February 18, 2025

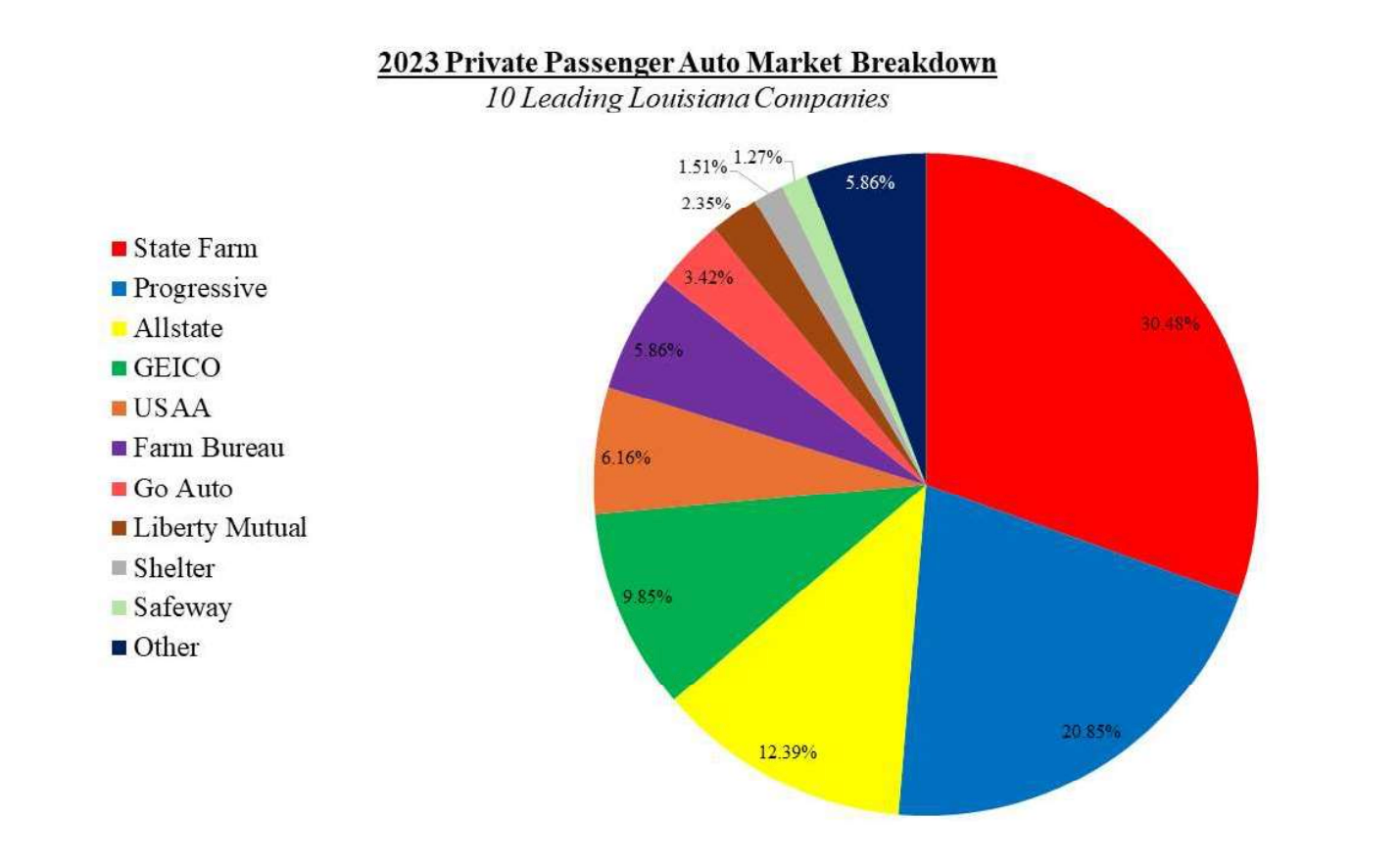

Big Insurance's Louisiana Boondoggle. Former Missouri State Insurance Commissioner Jay Angoff recently testified before the Louisiana Senate Judiciary A Committee. The former commissioner reviewed data provided by insurance companies to the National Association of Insurance Commissioners (NAIC). The hearing and most of the data presented focused on personal and commercial auto insurance. A key takeaway on personal auto from the NAIC data was that Louisiana's insurance market is competitive and profitable. This revelation was particularly interesting because it undercuts Commissioner Tim Temple's analysis of the Louisiana insurance market and his legislative agenda. Commissioner Temple has repeatedly stated: "If we get more companies in Louisiana, then that helps solve issue number one which is availability. Once you have more companies in Louisiana, that helps work on problem number two which is affordability.” Yet, the data presented by former Commissioner Angoff painted an entirely different picture.

By Ben Riggs

•

February 18, 2025

Expert, Former Commissioner Testifies on Louisiana's Insurance Market. Former Missouri State Insurance Commissioner Jay Angoff recently testified before the Louisiana Senate Judiciary A Committee. The former commissioner reviewed Louisiana’s insurance regulations, other states’ laws, and information provided by insurance companies to the National Association of Insurance Commissioners (NAIC). Mr. Angoff provided a detailed, data-filled report on Louisiana's insurance market. He explained how lax regulations that make Louisiana an extreme outlier contribute to high insurance rates. Additionally, he discussed the high returns insurers are seeing on policies in Louisiana and the massive profits rolling in on investments on their $1 trillion surplus. Below are highlights from the hearing and a copy of Mr. Angoff's complete report and testimony.

By Ben Riggs

•

February 18, 2025

New U.S. Senate Report Shines Light on Louisiana's Insurance Crisis. In 2024, Commissioner Tim Temple and lawmakers repealed a crucial safeguard for Louisiana policyholders, allowing insurers to cancel home insurance policies at will. This alarming change took effect on January 1, 2025, leaving policyholders vulnerable. Why is this important: The increased threat of severe weather has led to a rampant increase in non-renewals nationwide. The New York Times reports that "since 2018, more than 1.9 million home insurance contracts nationwide have been dropped. In more than 200 counties, the nonrenewal rate has tripled or more." This is all according to findings in a new report from the U.S. Senate Budget Committee. T h e report notes that "Florida and Louisiana — the top two states by non-renewal rate in 2023 — also experienced 280% and 267% increases, respectively, in non-renewal rate percent change from 2018 – 2023." Lafourche, Terrebonne, and Jefferson Parishes have among the highest non-renewal rates in the nation for 2023. Orleans, Terrebonne, and Tangipahoa Parishes have suffered among the largest increase in non-renewals.

By Ben Riggs

•

February 16, 2024

Insurance Industry: "Credit Scores" Among Reasons for Louisiana's Rising Insurance Costs. A new report shows that auto insurance rates are skyrocketing, rising by 26% across the U.S. On average, Louisiana drivers pay $2,909 annually, roughly 6.53% of their income for auto insurance. Wayne Watley at Watley Insurance Group lists “credit scores” among the reasons for Louisiana’s rising auto insurance costs, including poor roads and uninsured motorists. Mr. Watley goes on to say, “It’s a challenge because we’re not one of the richest states, but we have some of the highest premiums.” He is correct—and the data backs him up. Insurance companies use credit scores to determine insurance rates for policyholders. Louisiana ranks 48th in median household income and 49th in average credit score . According to a recent study , safe drivers in Louisiana with poor credit pay 111% more than safe drivers with excellent credit ($1,505 / $713). Consequently, Louisiana has the second-highest auto insurance rates in the nation, which leads to more uninsured motorists, another primary cause of higher insurance rates. The use of credit scores in rate setting also creates perverse incentive structures that make Louisiana roads less safe. In Louisiana, safe drivers with poor credit pay an average of $905 more than drivers with a DWI and excellent credit ($3,548 / $2,643). Meanwhile, traffic fatalities increased by 21% from 2019 to 2022 in Louisiana, and the fatality rate per 100 million vehicle miles traveled increased by 18%, according to KPLC . Louisiana desperately needs real insurance reforms that lower costs, protect consumers, hold insurers accountable, and make our roads safer.