Are Louisiana Policyholders Subsidizing Insurer Profits in California with High Premiums?

“Higher [insurance] premiums are being charged in states where regulators apply less scrutiny to requests for rate increases,” according to new reporting from the New York Times.

Dr. Ishita Sen, a professor of finance at Harvard Business School, and her co-authors, Sangmin S. Oh and Ana-Maria Tenekedjieva, have uncovered a concerning trend. Homeowners in states with weak consumer protections may be significantly overpaying for property insurance, subsidizing homeowners in states with more robust consumer protections. In other words, ratepayers in Louisiana, where regulations are lax, could pay more for home insurance to pad the profits of insurers who struggle to raise rates in states like California, where consumer protections are stronger.

The consequences have been devastating for Louisiana families and small businesses.

“Across the more than 9,000 ZIP codes for which data was available, the typical American household last year paid about $500 in home insurance premiums for every $100,000 of home value, or 0.5 percent.”

However, your average policyholder in many California zip codes paid premiums as low as .05 percent of home value despite the state suffering over 7,000 wildfires last year.

Compare that with Louisiana, where in parts of the state, policyholders paid “insurance premiums greater than 2 percent of the value of local homes.”

According to the Times-Picayune | Advocate, “In 2020, the buyer of a median-priced home in New Orleans would pay about $1,400 a month in housing costs, assuming they put 20% down and paid an average rate for insurance from Louisiana Citizens, then about $142 a month...With increases in home insurance, flood insurance and interest rates, the same home would cost $2,154 a month now.”

As a result, a family that needed a $57,000 income to afford their home in 2020 would now need “north of $86,000 a year” in a metro area where the median household income is $61,602 per year.

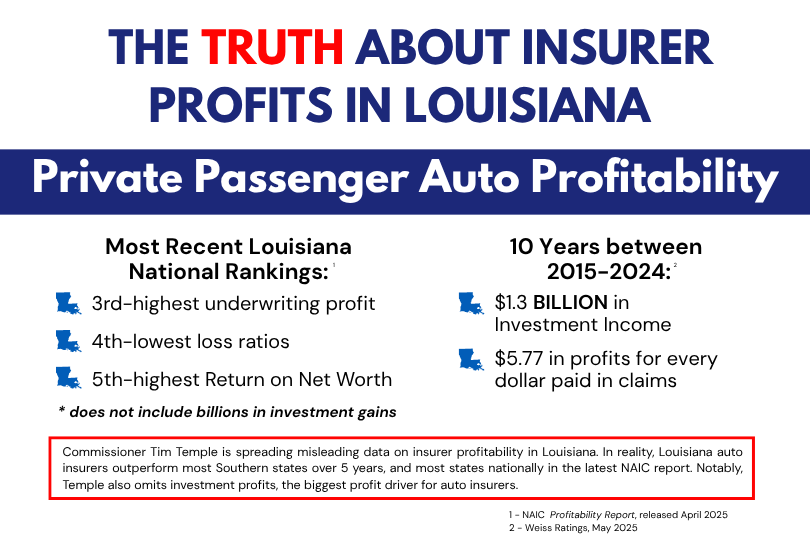

To make matters worse, incoming Insurance Commissioner Tim Temple has worked to pass a series of industry-friendly bills while at the same time using his position to deregulate Louisiana’s insurance market. Temple lifted the cap on expected profits built into rates filed with the Department of Insurance and pushed for the passage of SB 295, which allows insurance companies to raise their rates more often, without prior approval of the Insurance Commissioner.

Commissioner Temple’s anti-consumer actions will result in more rate increases in Louisiana, padding the already massive profits for big insurance companies on the backs of families struggling to make ends meet.