Five Alarm Insurance Crisis; Regulators, Lawmakers Keep Pointing at Red Herring.

Five large U.S. property insurers—including Allstate and Berkshire Hathaway (Geico)—have notified regulators that they will no longer be writing policies in some coastal regions or covering natural disasters and that they intend to raise premiums and deductibles. This is according to a bombshell report by the Washington Post.

The insurers cited more frequent extreme weather events as the cause for these changes—not litigation or the regulatory environment, as Commissioner Jim Donelon, industry-friendly lawmakers, and lobbyists routinely claim.

The Washington Post story is based on a survey by the National Association of Insurance Commissioners, wherein big insurance companies state their plan to omit wind and hail damage from policies underwriting coastal properties. Respondents to the survey cover 80% of the U.S. Insurance market. The National Association of Insurance Commissioners is an organization created and governed by the chief insurance regulators from the 50 states, including Louisiana Commissioner Jim Donelon.

"Commissioner Jim Donelon knows that more frequent, more powerful storms are the root cause," said Ben Riggs, Executive Director of Real Reform Louisiana. "Yet Commissioner Donelon and industry-friendly lawmakers continue to point the finger at storm victims for increased costs, diminished coverage, and a lack of availability, falsely claiming that policyholders holding their insurer accountable in court is the cause of our insurance crisis.

"Louisiana families are suffering a five-alarm insurance crisis," said Riggs. "As extreme weather increases their need for coverage, insurers are withdrawing from our state and pricing families out of their homes. Unfortunately, the elected officials charged with addressing the crisis are focused on scapegoating others, not real solutions."

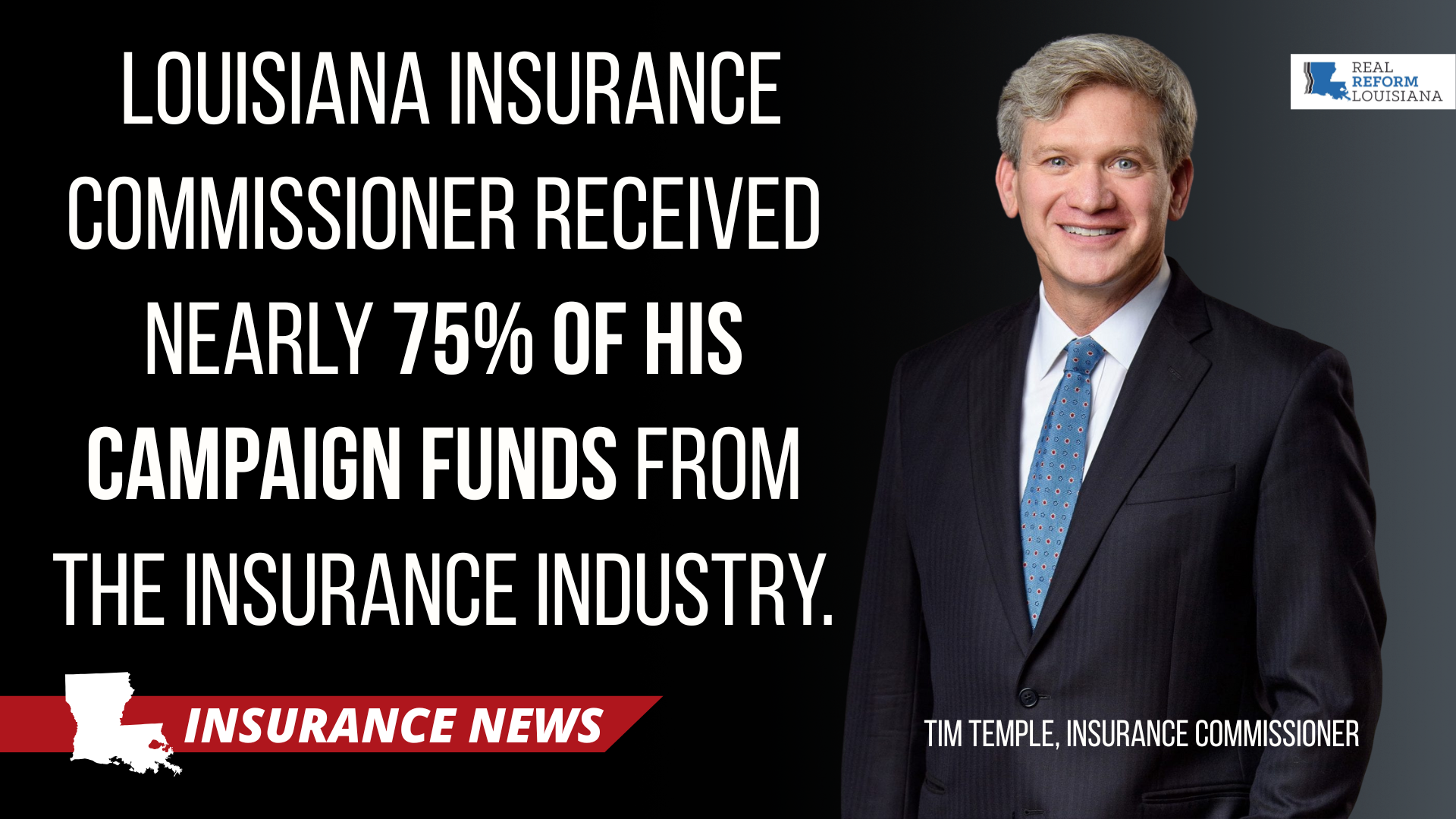

Commissioner-elect Tim Temple has an opportunity to reset and offer solutions that address the underlying issues. Unfortunately, his agenda seems to be veering more and more towards the threadbare, industry-friendly policies backed by Donelon.

"Louisiana consumers need real leadership to reduce insurance costs and safeguard them from exploitation," said Michael DeLong, Research and Advocacy Associate at Consumer Federation of America. "Florida passed laws making it harder for consumers to hold insurers accountable, and yet their insurance costs are higher than ever. This focus on tort reform is a trick and won't meaningfully help policyholders."

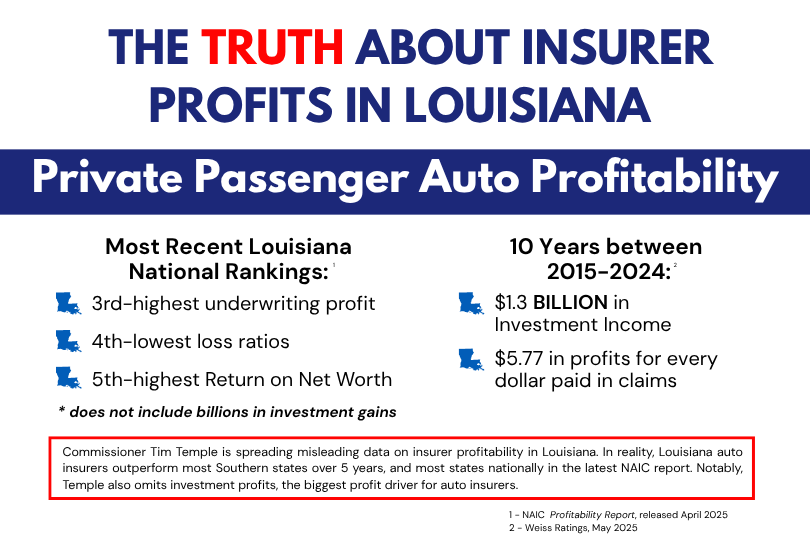

The fact is more frequent and less predictable extreme weather is driving the insurance crisis in Louisiana. And we cannot resolve this crisis by continuing to point the finger at tort reform red herrings. We know tort reform does not work because we have all suffered its abysmal failure to lower auto insurance premiums in Louisiana.

Louisiana needs real reforms that actually increase competition and lower costs while recognizing the rights of policyholders and holding big insurance companies accountable. That means mitigating risk by addressing the underlying issues through more significant investments in storm mitigation, drainage, and efforts to fortify roofs.

Everything else is a distraction.