Louisiana Insurance News

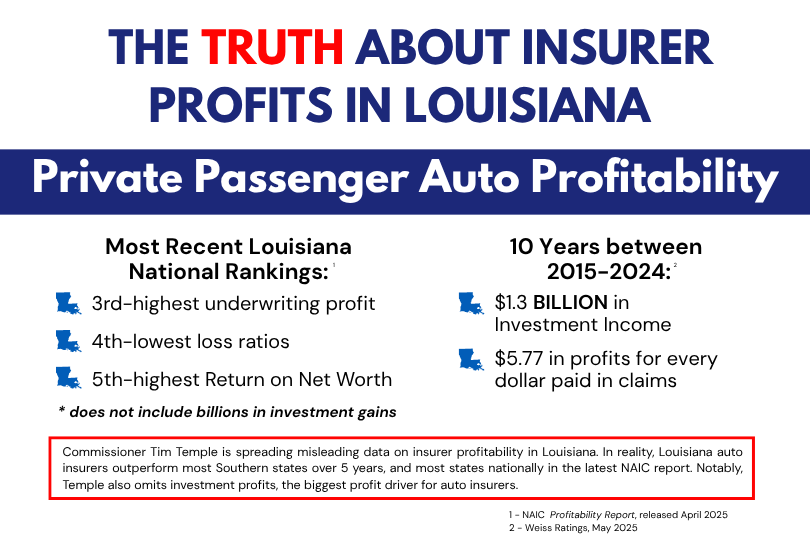

Insurance lobbyists and industry-friendly lawmakers routinely say Louisiana needs to deregulate to become more attractive to insurers.

But recent revelations make it clear that Louisiana needs more accountability and transparency when it comes to insurance, not less.

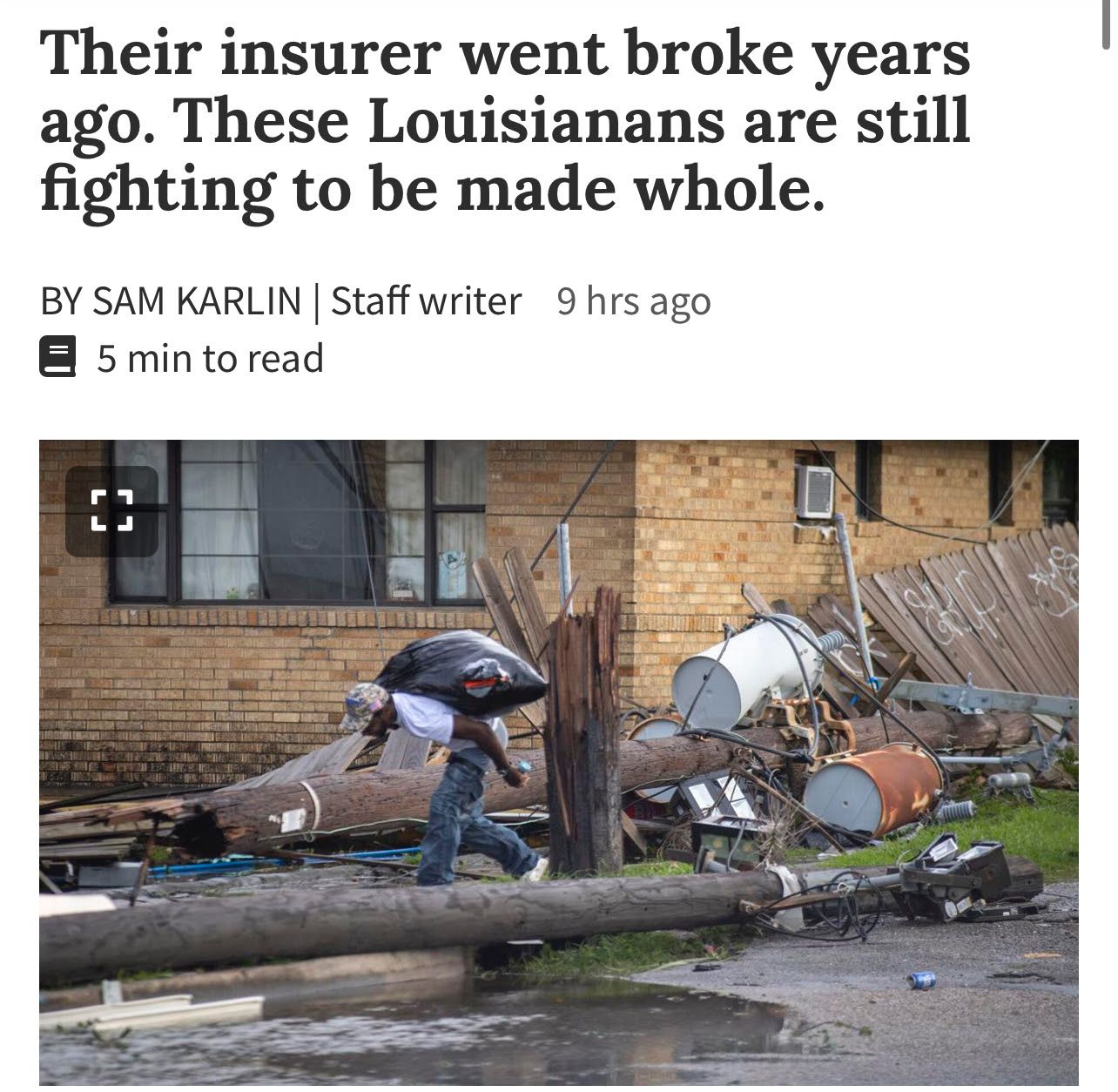

The Advocate's Sam Karlin recently published a four-part series on Louisiana's insurance crisis, detailing the dark truth behind the collapse of our insurance market (Part 1 - Part 2 -

Part 3 -

Part 4).

Following Hurricanes Laura and Ida, eleven insurance companies went belly up. These companies

"operated under a structure that sent hundreds of millions of dollars off the books of the insurer to less-regulated affiliates," according to

the Advocate. One of the failed companies, Southern Fidelity, even

purchased a $5.7 million hunting lodge, which company lawyers said the CEO and his family used as a “personal residence” for years.

The state eagerly welcomed these eleven insurers with loads of grant money and tens of thousands of policies from Citizens, the state's insurer of last resort. Consequently, when these eleven insurers failed, they comprised one-sixth of Louisiana's market.

Their collective failure had devastating effects on Louisiana's insurance market.

Hundreds of thousands of Louisiana homeowners were burdened with sharp premium increases of

up to 111%. Tens of thousands of storm victims were stuck in insurance purgatory, and Louisiana taxpayers were forced to cover tens of thousands of unpaid claims.

When these insurers collapsed, more than 41,000 unpaid claims were absorbed by the Louisiana Insurance Guaranty Association (LIGA), a taxpayer-funded state nonprofit that handles ongoing claims from failed insurance companies.

LIGA is expected to pay north of $1 billion in claims and premium refunds.

The Advocate

also reports that 15,294 policyholders remain stuck in insurance purgatory, waiting for their claim to be paid. To make matters worse, LIGA is immune to attorney fees, so

policyholders will never be made whole.

Moreover, according to

the Advocate, Louisiana led the nation in 2022 in claims paid after 60 days, which resulted in more complaints against insurance companies and more litigation. A Louisiana Legislative Auditor found that 67% of complaints were settled in favor of the policyholder.

The delays, denials, and lowball offers from insurers have only exacerbated the suffering of Louisiana storm victims. The Department of Insurance has found that

insurers have failed to follow state laws and forced policyholders to litigate their claims.

“Louisiana's insurance market collapsed, in part, because insurers comprising one-sixth of the market failed after sending hundreds of millions of dollars to unregulated, off-the-books affiliates, instead of paying claims for policyholders,"

said Ben Riggs, executive director of Real Reform Louisiana, a consumer advocacy group fight for insurance reforms.

"Louisiana cannot afford to continue listening to the insurance industry about how to solve the insurance crisis. That's putting the fox in charge of the hen house. We must protect the rights of policyholders. Louisiana desperately needs real insurance reform that lowers rates, holds insurance companies accountable, and ensures transparency for policyholders.”

Click here to contact your legislator and demand change!

Read the four-part bombshell series from the Advocate below: