From nola.com:

Drivers in Louisiana already pay some of the highest rates for car insurance in the country. A new report suggests local drivers also lead the country in the amount they overpay for coverage.

Drivers with car insurance policies in Louisiana paid $3,111 a year on average for 12-month coverage in 2018, the highest rate in the nation, according to data analyzed by Gabi, an insurance comparison website and app. Gabi’s analysis looked at premiums paid by more than 130,000 users nationwide, comparing them to average rates in each region for multiple major insurance companies.

To develop the analysis, drivers shared information with Gabi about how much they pay for insurance and basic policy details. Gabi then took that information and compared it to averages for that type of driver and policy, among multiple major insurance companies. The analysis found the average Louisiana driver paid roughly $1,159 more than they could have for car insurance in 2018.

That was more than a third of the total average premium paid by local drivers, and the highest amount overpaid in all 50 states.

Louisiana remains among the most expensive states for car insurance because of a number of factors, including a high rate of uninsured drivers as well as a high rate of auto litigation. Many Louisiana drivers who do buy insurance have minimum coverage. As a result, many turn to the courts to get larger payouts in the case of a serious accident.

Last year, state regulators approved rate hikes for multiple insurers, though there are signs rates may be leveling out. State Farm said in February it would cut auto rates by 3.2 percent this spring. State Farm insures roughly a third of all Louisiana drivers.

State Farm to cut Louisiana auto insurance rates again

Nationwide, a rise in accidents caused by distracted driving, linked to growing smartphone use in vehicles, has led to rising rates. Distracted drivers killed 3,450 people and injured another 391,000 in 2016, according to the latest data from the National Highway Traffic Safety Administration.

In an emailed explanation, Hanno Fichtner, CEO of Gabi, noted a number of factors affect how much an individual pays for car insurance, including one’s credit score and where you live. (Cities have a higher density of drivers and tend to have more accidents reported, thus higher premiums.)

Rates are also lower in states like Maine where there are many different insurance providers and competition is high, Fichtner said. Maine drivers paid an average premium of $1,447 a year in 2018, according to the Gabi analysis. Still, Maine drivers overpaid for insurance, to the tune of about $673 a year, or nearly half the total average 12-month payment.

The one way drivers can consistently lower their auto insurance rate? Shop around, the report says.

Indeed, Louisiana Insurance Commissioner Jim Donelon has repeatedly urged drivers facing a rate hike to shop for a new policy. Insurers in Louisiana get one rate increase or decrease per year. Officials recommend reassessing your coverage options at least once a year.

Here’s a look at the top 10 states where Gabi found drivers overpay for car insurance the most. States are ranked by the total amount overpaid on average.

Credit penalties are jacking up home insurance rates that are crushing Louisiana policyholders. Year after year, the insurance industry opposes real insurance reforms that would lower rates by prohibiting insurers from penalizing Louisiana policyholders with poor credit. And year after year, the Louisiana legislature sides with industry, rejecting these basic consumer protections. Now, the Consumer Federation of America has published a bombshell report that calculates the price Louisiana policyholders pay for Commissioner Temple’s and the legislature’s allegiance to big insurance. According to the report, home insurance companies operating in Louisiana mark up home insurance policies an average of $3,754 for customers with poor credit; that’s an 87% increase. For those with middling credit, there is an increase of $1,503, a 35% increase. Home insurance should be based on risk, not credit. The tactic is particularly harmful in Louisiana, where we have the second-lowest average credit score . This unjust tactic unfairly penalizes individuals with poor credit, resulting in outrageous home insurance premiums in Louisiana that significantly exceed the risks associated with the policy. Louisianans can no longer afford to listen to the insurance industry. We are putting the fox in charge of the hen house. Louisiana desperately needs real insurance reforms that lower rates, protect consumers, and hold big insurance companies accountable. Real Reform Louisiana is a member of the Consumer Federation of America.

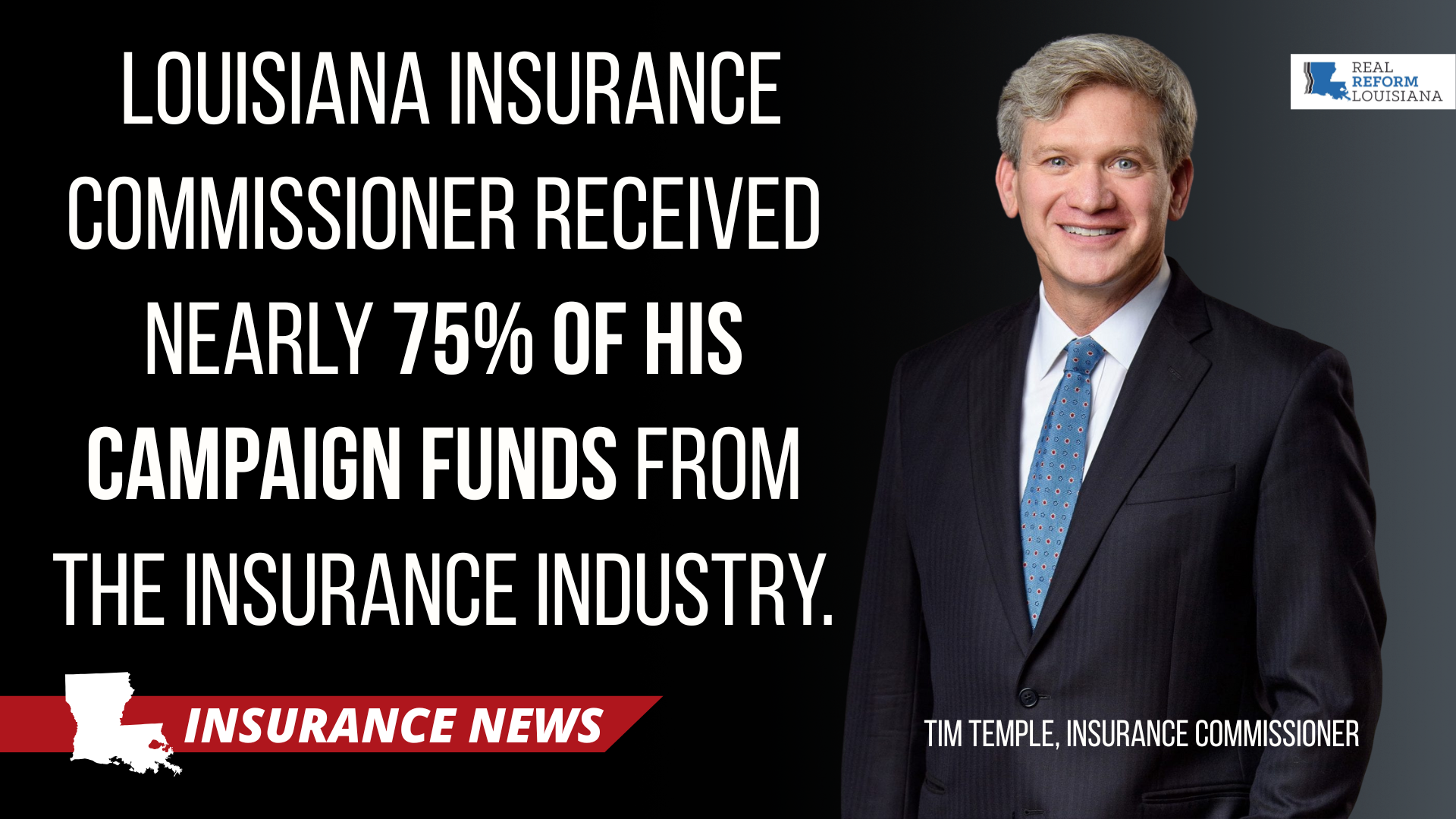

Is Louisiana in Good Hands with Commissioner Temple? Commissioner Tim Temple received nearly 75% of his campaign contributions from the insurance industry, as reported in the Advocate-Times Picayune. Commissioner Temple is a former insurance executive whose family owns an insurance company. Temple has pushed a radical anti-consumer agenda since being elected without opposition in 2023. Temple lifted profit caps for insurers, made it easier for them to raise rates, deny claims, and cancel policies —all while pushing legislation that makes it harder for Louisiana policyholders to file claims and hold insurers accountable. At the same time, insurance companies are reporting record profits. In 2024, the industry reported a 91% spike in profits, reaching a record $166.8 billion! In Louisiana, auto insurers had the third-highest profit in the country, while home insurers have reported $55 profit for every dollar lost since 2004. In short, Big Insurance has gotten its money's worth. Commissioner Temple’s job is to regulate the industry that funded his campaign. But instead of regulating insurance companies, Commissioner Temple has repeatedly pushed the industry’s agenda. Temple is regulating the people of Louisiana, making it harder for them to get claims paid and hold their insurer accountable. It’s a blatant conflict that should concern every Louisiana citizen and give pause to lawmakers following Temple off the tort reform cliff.

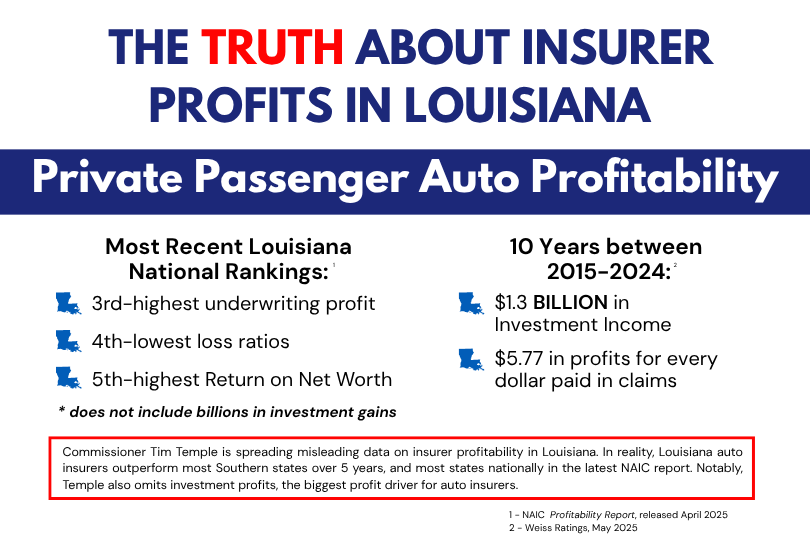

The truth about insurer profits in Louisiana. Insurance Commissioner Tim Temple is a former insurance executive whose family owned an insurance company. Temple received nearly 75% of his campaign contributions from the insurance industry. During this legislative session, Commissioner Temple has pushed a radical, pro-insurance agenda that pads insurer profits by stripping policyholders and accident victims of their rights. To advance that agenda, Commissioner Tim Temple has pushed misinformation about the profits of insurers operating in Louisiana. Here are the facts about insurer profits in Louisiana: As Warren Buffet (who owns GEICO) explains in this shareholder letter , auto insurance companies make most of their profits from investing your premium dollars, not underwriting insurance policies. Nevertheless, Louisiana was one of 18 states to make an underwriting profit, according to the most recent NAIC profitability report. Louisiana had the third-best underwriting profit nationally according to the report. But investments are where they make the big bucks: According to a recent report from Weiss Ratings , auto insurers operating in Louisiana made $1.3 BILLION in investments between 2015-2024, which comes to $5.77 for every dollar lost in underwriting. While the highest rates in the nation are a key chunk of insurers' big profits in Louisiana, another significant component is denying claims. Private passenger liability claims closed without payment has increased from 39.2% of total claims in 2015 to 45.2% in 2024, according to Weiss. The truth is BIG INSURANCE COMPANIES are raking in record profits while Louisiana families and small businesses are paying unaffordable rates and seeing their claims denied at an alarming rate.

5 Facts About Louisiana's Insurance Market. 1) High Rates: Louisianans pay the highest auto insurance premiums in the nation ($3,481 per year) and the 5th highest home insurance premiums ($4,291). - Marketwatch/Bankrate, June 2025 2) Huge Profits: Auto insurers operating in Louisiana have the 3rd highest underwriting profit in the country, meaning they charge high premiums and pay out less in claims. - NAIC, April 2025 3) $55 profits for every $1 lost: Since 2004, home insurers operating in Louisiana made $88.3 billion investing your premium dollars and reported just $1.6 billion in underwriting losses, meaning they made $55 profit for every dollar they lost. - Weiss, May 2025 4) Not paying Claims: Home insurers operating in Louisiana denied 44.6% of claims filed in 2024, which is significantly above the national average. Auto insurers denied 45.2% of private passenger liability claims in 2024. -Weiss, May 2025 5) Tort Reform Does Not Work: Rates are still high, insurers are making record profits, while denying claims at an alarming rate. It’s obvious: tort reform guts consumer protections to pad insurer profits.

Louisiana families struggle, as corporate fat cats live high on the hog! The latest numbers are in, and they're appalling. In 2024, Property & Casualty insurers reaped a staggering $170 BILLION in profits —a 91% jump from 2023 and a jaw-dropping 330% surge from 2022! Meanwhile, their executives are rolling in dough, with 9 of the top home insurers' executives pocketing a whopping $310 MILLION in compensation. Who's footing the bill? Sadly, it is Louisiana policyholders . Louisianans pay the second-highest annual premium in the nation—with t hat number expected to rise another 27% by the end of 2025 . Nevertheless, year after year, the industry and its allies in the legislature pass tort reform laws that gut consumer protections. As a result, nearly half of all claims in Louisiana are closed without payment. Due to sky-high rates, a lax regulatory environment, and weak consumer protections, property insurers operating in Louisiana have raked in a shocking $55 in profit for every dollar they have lost over the last 20 years. Moreover, automobile insurers in Louisiana are also making out like bandits, as rates are among the highest in the nation despite auto insurers operating in Louisiana having the 3rd highest profit and some of the best loss ratios in the country. We cannot afford to sit idly by while Louisiana families and small businesses struggle to get by and these corporate fat cats live high on the hog! Tort reform does not lower rates. It pads the profits of big insurers and stuffs the pockets of executives. We must pass real insurance reforms that lower rates, hold insurers accountable, and strengthen consumer protections.

Rates Continue to Climb as Claims Paid Decrease Weiss Ratings, the nation's leading independent rating agency, issued a bombshell report that sheds light on "three alarming trends" with property insurers operating in Louisiana. The big takeaway: Tort reform does not work. The central argument from proponents of tort reform is that cutting costs for insurers will result in savings for policyholders. However, the data suggests that insurers are closing a startling number of claims without payment as rates continue to climb. According to Insurify , Louisiana rates are expected to rise another 27% in 2025, following a 38% increase in 2024. Additionally , Weiss Ratings found that eight property insurers who received taxpayer dollars through the Insure Louisiana Incentive Program "have a long history of poor business performance" and "above-average claims denials." Three Alarming Trends Insurance companies operating in Louisiana closed nearly half of homeowners' claims (44.6%) with no payment in 2024, which is significantly higher (+2.7%) than the national average and 18.9% higher than the national average in 2004. This highlights the devastating effects of tort reform. According to Weiss Ratings , seven companies operating in Louisiana closed more than 50% of their claims with no payment. Kin Insurance (68.3%) and Spinnaker Insurance (60.6%) closed more than 60% of claims with zero payment. Insurance companies operating in Louisiana have raked in "$88.3 billion from investments and other sources," far exceeding their "$1.6 billion in underwriting losses," which insurers often use to justify rate increases and tort reforms that gut policyholders' rights. "That’s $55 in profits for each $1 of underwriting losses," according to Weiss. Insurers operating in Louisiana moved $27.1 billion off the books to affiliates, effectively hiding these funds from regulators, lawmakers, and the ratepaying public. This could also account for a significant percentage of the underwriting losses reported by insurers operating in Louisiana. “Louisiana homeowners are being shortchanged by insurers prioritizing profits,” said Dr. Martin D. Weiss, founder of Weiss Ratings. “Regulators must act, and homeowners should choose insurers with fair practices and strong ratings.” Poor Stewards of Taxpayer Dollars The Insure Louisiana Incentive Program used taxpayer dollars to encourage insurers to write policies in Louisiana, particularly in storm-prone areas and to help depopulate the rolls of Citizens, the insurer of last resort. According to Weiss , the eight insurers approved to receive grant funds have reported "net underwriting losses of $357 million" over the last ten years. These insurers have shifted $174 million in fees to affiliate companies, off the books and out of sight of regulators, which accounts for 48.4% of their total underwriting losses. "On average, the eight companies closed 42.1% of claims with no payment in 2022, an even higher 45% in 2023, and an alarming 51.1% in 2024," according to Weiss. This disturbing trend demonstrates that insurers cannot be trusted to act in the public's interests with taxpayer dollars, as well as the devastating effects of tort reforms, which make it harder for policyholders to file claims. "We've heard the insurance industry repeatedly promise that tort reforms will reduce costs and ultimately lead to savings for policyholders. Sadly, we have seen rates continue to climb as the number of claims paid decreases," said Ben Riggs, executive Director of Real Reform Louisiana. "We cannot continue to trust and cater to the insurance industry. Louisiana families and small businesses desperately need real insurance reforms that lower rates, protect policyholders, and hold insurers accountable."