Louisiana Families Feeling Pain of Insurance Crisis, Survey Shows

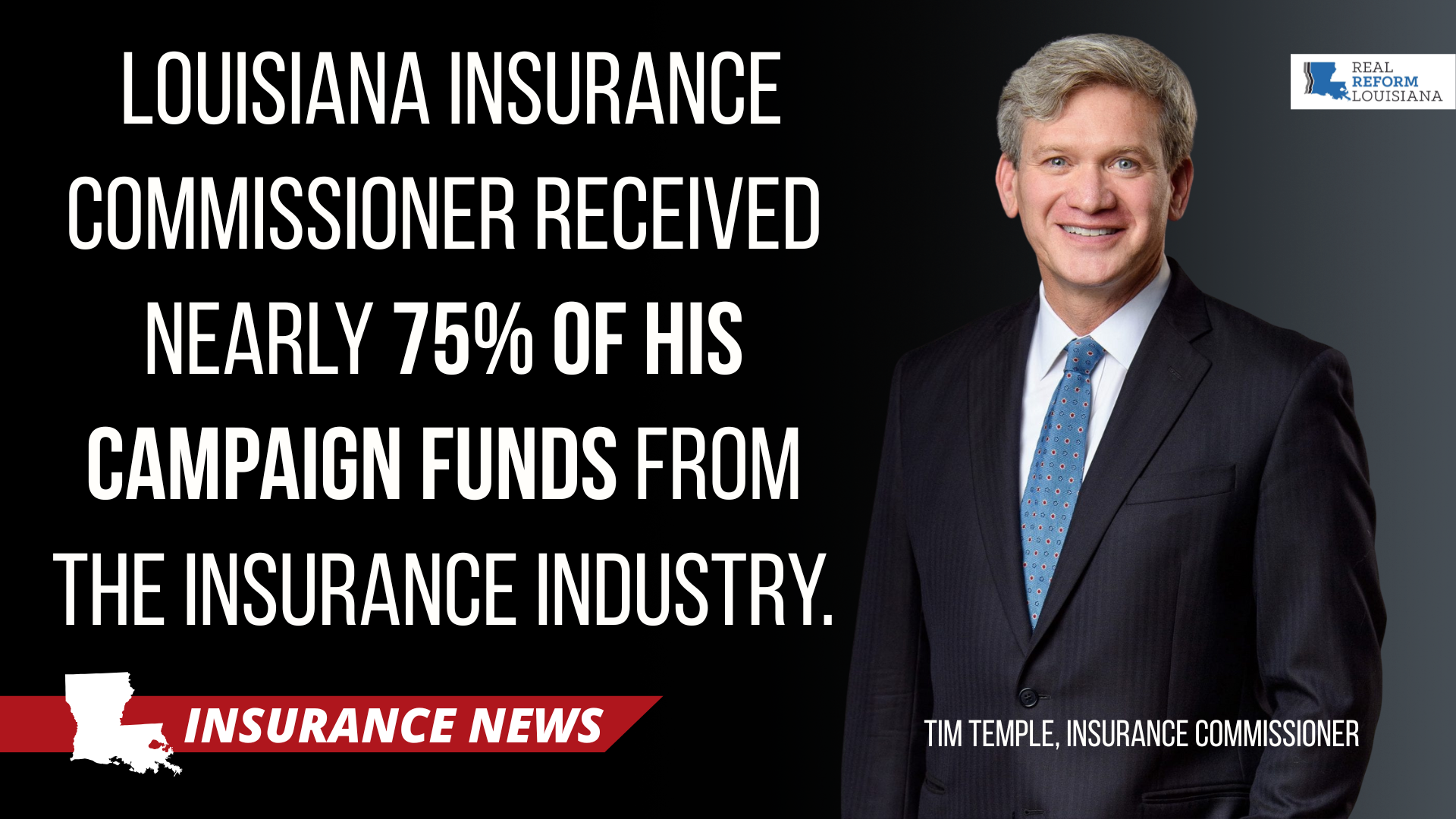

June is the beginning of the hurricane season and the end of the legislative session in Louisiana. As storms form in the gulf, big insurance companies continue to push industry-friendly legislation that disadvantages consumers, making it easier for insurance companies to raise costs, delay claims, and ultimately deny storm victims the money they need to rebuild their lives.

Louisiana desperately needs real insurance reform that benefits consumers by increasing competition, lowering costs, and increasing accountability for big insurance companies. Louisiana families are hurting, as evidenced by a recent survey conducted by the Reilly Center for Media & Public Affairs at LSU.

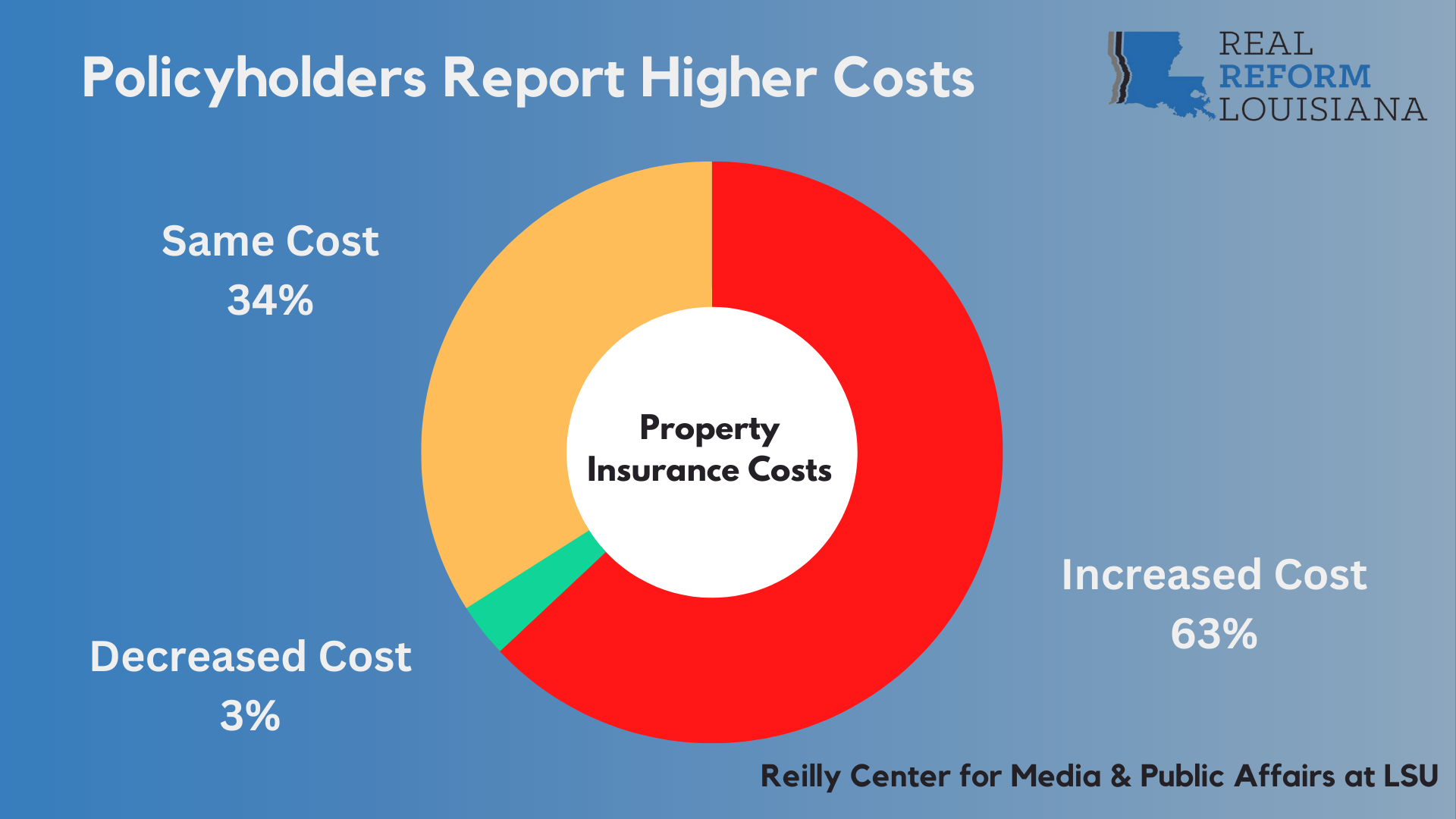

63% of Louisiana homeowners report that the cost of insurance increased. Only 3% reported paying less for homeowners insurance. Nearly 7 out of 10 respondents said insurance in Louisiana costs more than in other states.

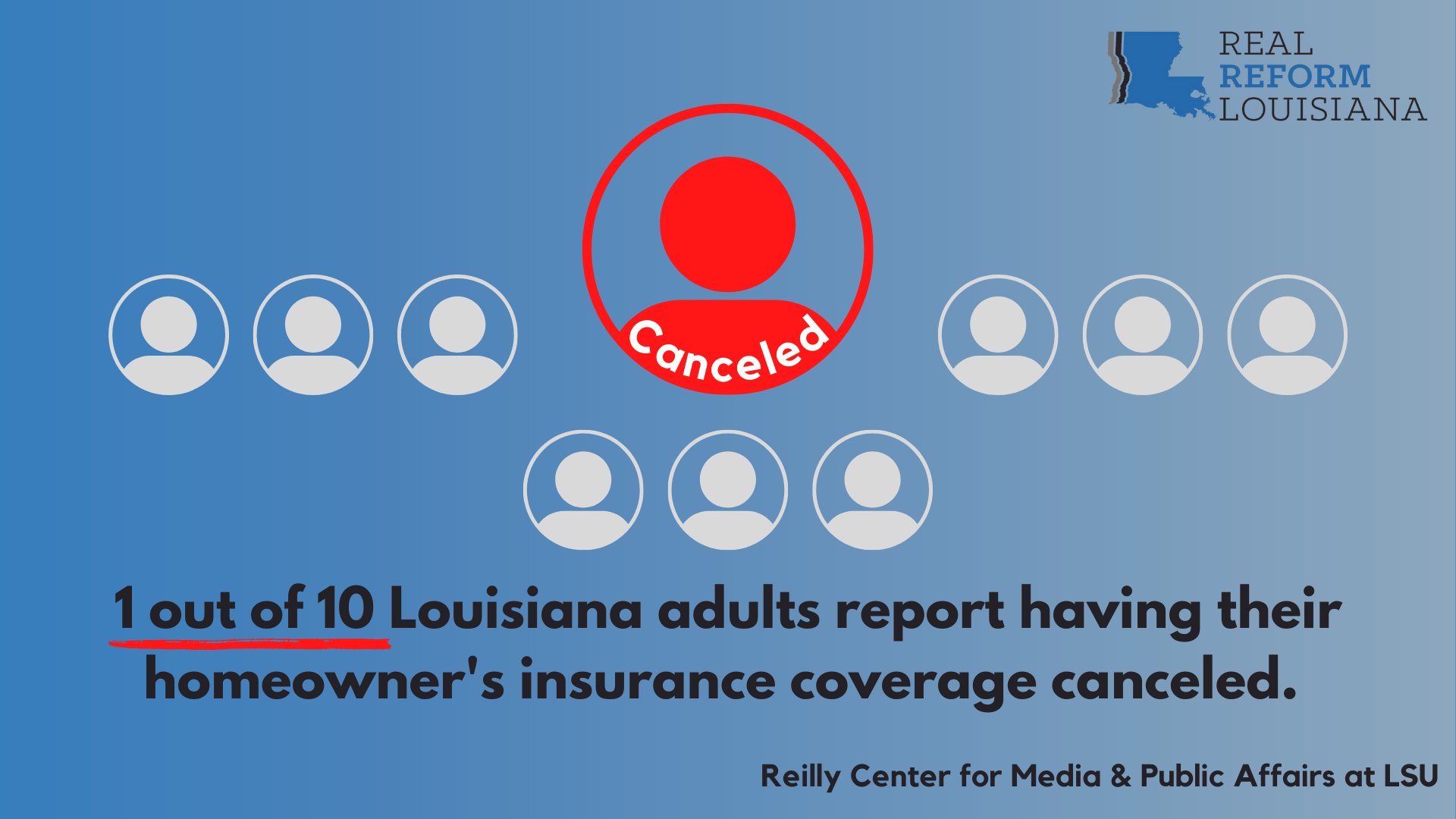

17% of Louisiana homeowners report that their insurer canceled their policy over the past year. That's nearly one-fifth of every Louisiana adult reporting that their homeowner's insurance coverage was canceled. Over half (55%) of the Louisiana homeowners who tried to find an insurance policy last year experienced difficulty getting coverage.

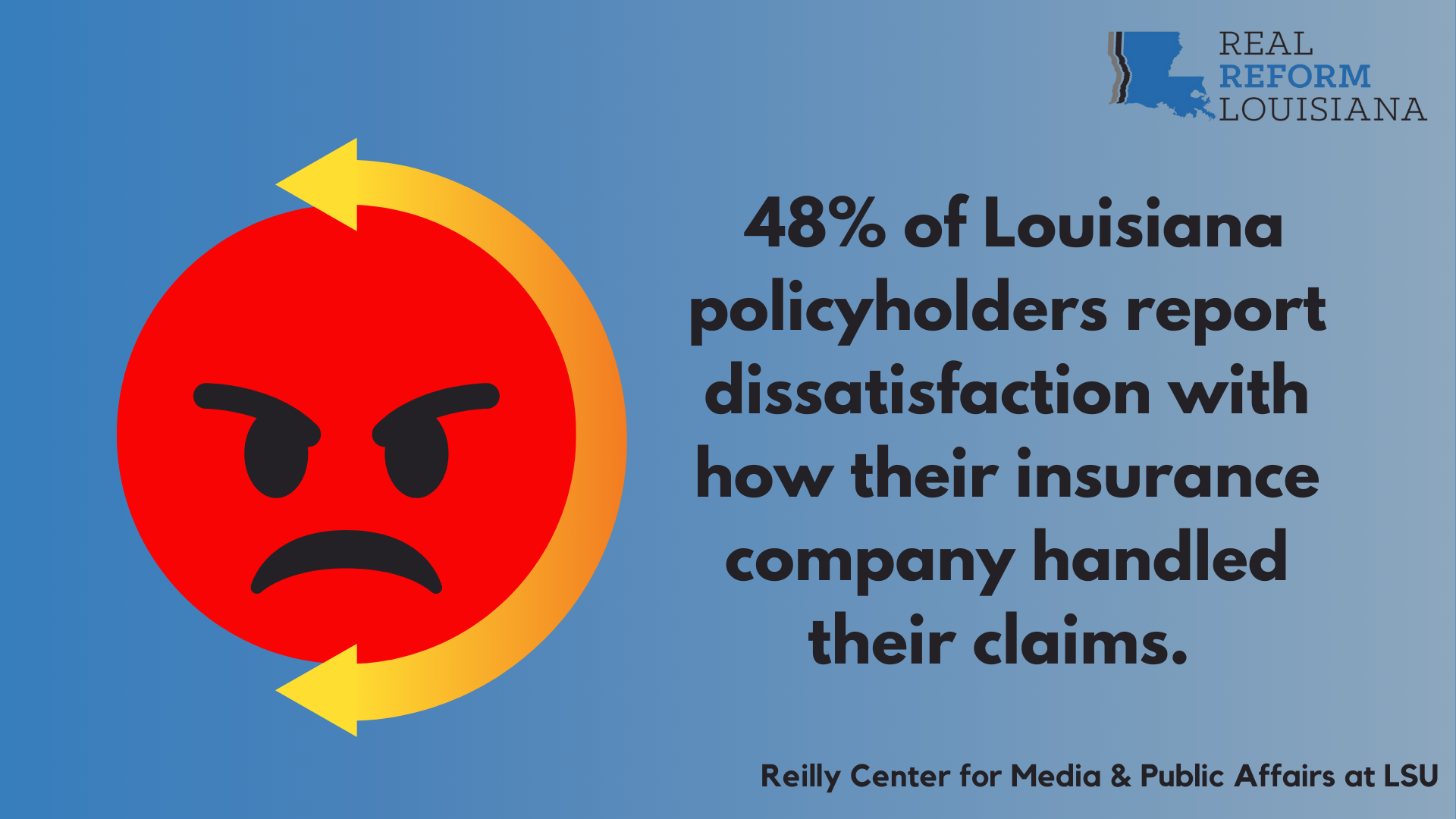

Roughly 1 in 5 adults have filed a property, flood, or renters insurance claim in the past two years, which accounts for 29% of all Louisiana policyholders. 48% of policyholders report dissatisfaction with how their insurance company handled their claims.

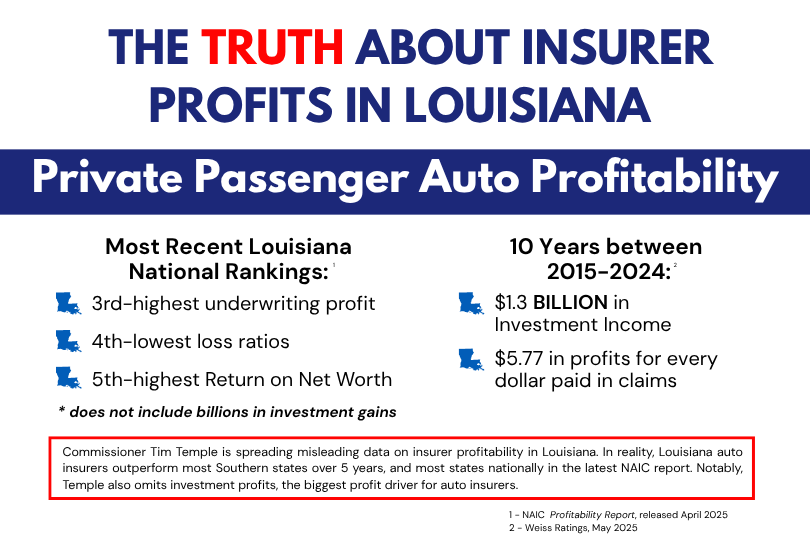

Louisiana families are also frustrated with broken promises. Two years ago, we were promised tort reform would lower automobile insurance rates. But only 10% of auto insurance policyholders reported paying less in the survey, while a plurality (43%) reported paying more.

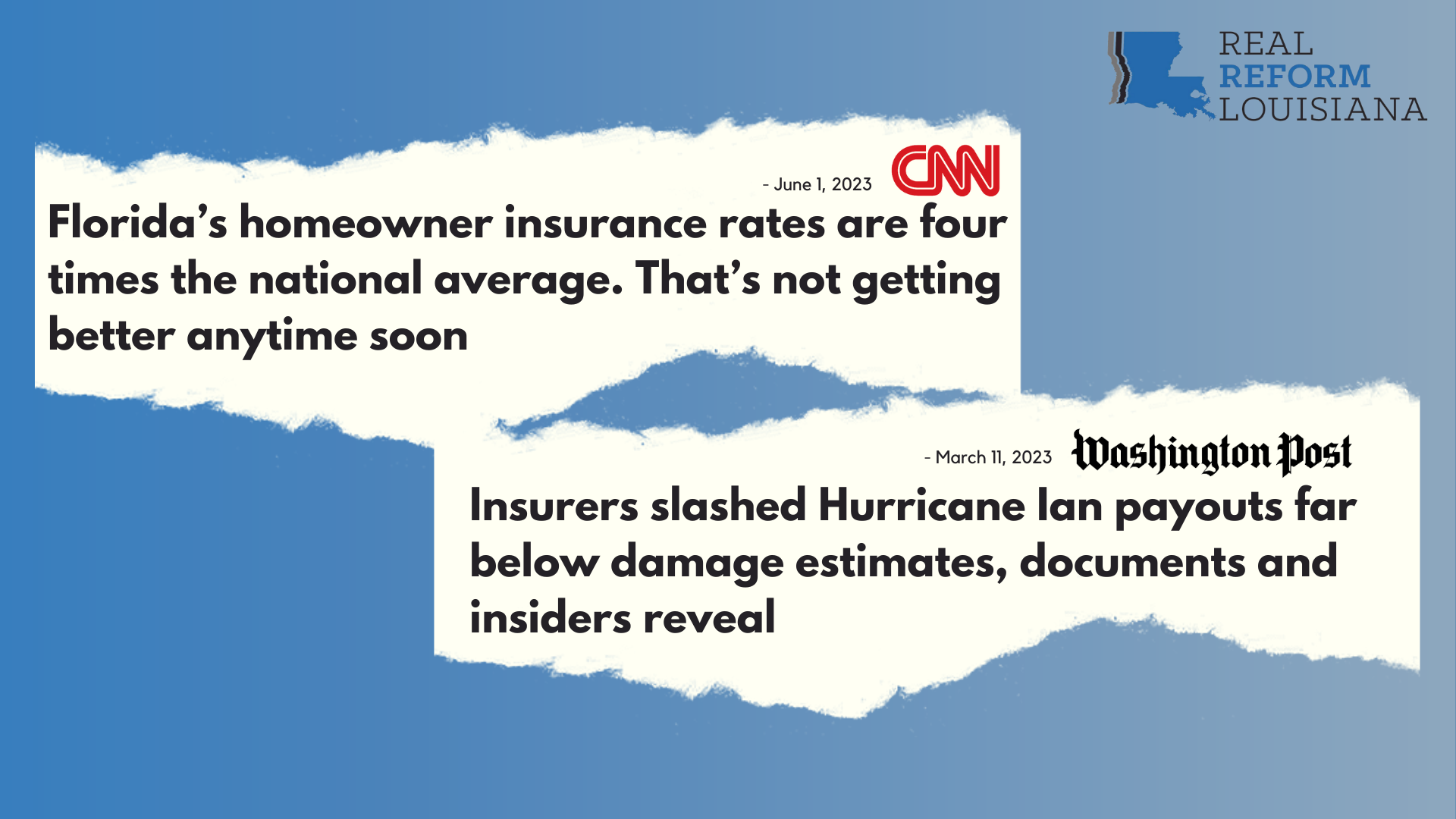

Now, the same people that promised tort reform would lower auto insurance rates are pushing the same false promise about property insurance. Tort reform will not lower home insurance premiums, as evidenced by the spiraling crisis in Florida.

The Sunshine State has passed several aggressive tort reform packages over the past two years. Yet, Florida's insurance rates are four times higher than the national average and insurance companies are defrauding policyholders at an alarming rate.