Insurance Company Caught Slashing Adjuster’s Initial Estimates Post-Ida

The Washington Post recently released a bombshell report exposing big insurance companies’ malicious practice of modifying adjuster estimates without notifying the adjuster or the policyholder. According to the Post, policyholders saw their claims slashed by 45% to 97% of what they were owed.

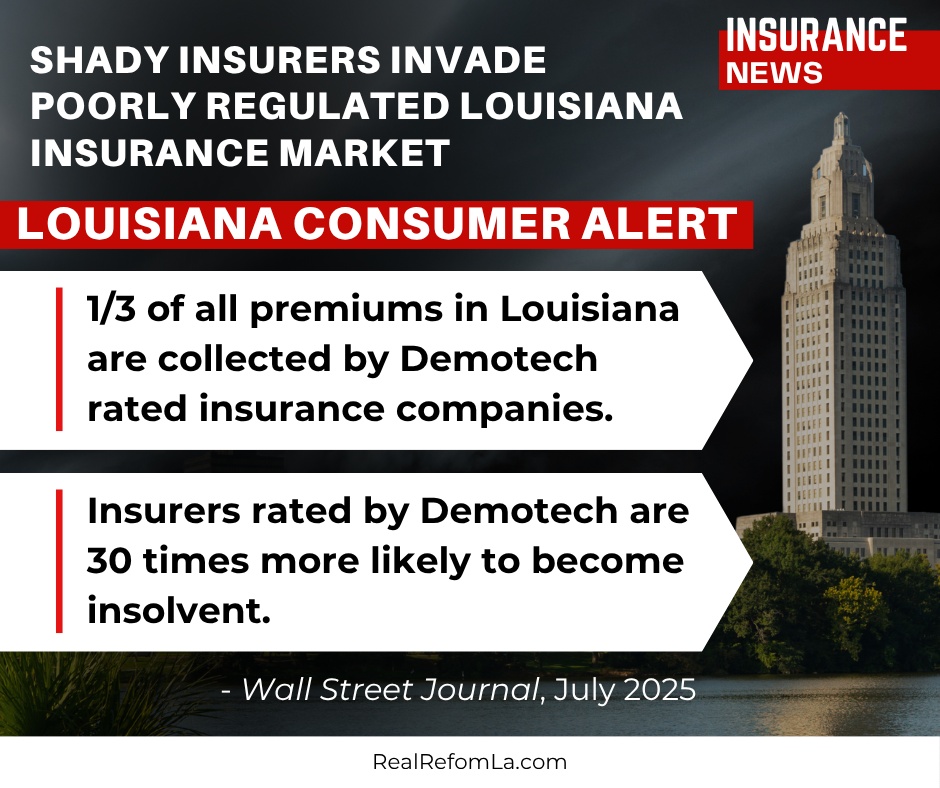

This practice is criminal—and it’s happening here in Louisiana, underscoring the need to strengthen consumer protections during the current legislative session.

An independent adjuster named Joseph Lahatte Jr. said, “They changed my estimate completely. I couldn’t believe it.”

The Insurance Journal reports, "Lahatte’s initial estimate for a home in Cut Off, Louisiana, in the low-lying area south of New Orleans, showed $182,137 in damage.” But after the insurance company gutted his estimate, the homeowner was awarded a meager $35,830. That’s a reduction of more than 80%!

Louisiana families and small businesses are still struggling to recover from three catastrophic storms, primarily due to big insurance companies acting in bad faith. They stonewall, lowball, delay, and ultimately deny claims, making it impossible for Louisiana families to get their lives back on track.

The insurance industry is currently pushing several bills through the Louisiana legislature that would make it easier for them to cheat consumers and harder for policyholders to hold them accountable. House Bills 183 and 601 and Senate Bill 96 are anti-consumer measures that incentivize insurance companies to lowball, delay, and deny damages owed to storm victims.

House Bill 287 by Rep. Cormier and Senate Bills 106 and 156 by Senators Smith and Duplessis are pro-consumer measures that increase transparency and make it easier for policyholders to hold insurance companies accountable when they act in bad faith.

Louisiana cannot afford to pass more pro-insurance legislation that weakens consumer protections as Louisiana families and small businesses continue to struggle against their insurance companies to rebuild their lives.

Let your state legislator know that you oppose House Bills 183 and 601, as well as Senate Bill 96—and that you support House Bill 287 and Senate Bills 106 and 156.