How Insurance Companies Make Big Bucks by Delaying Claims

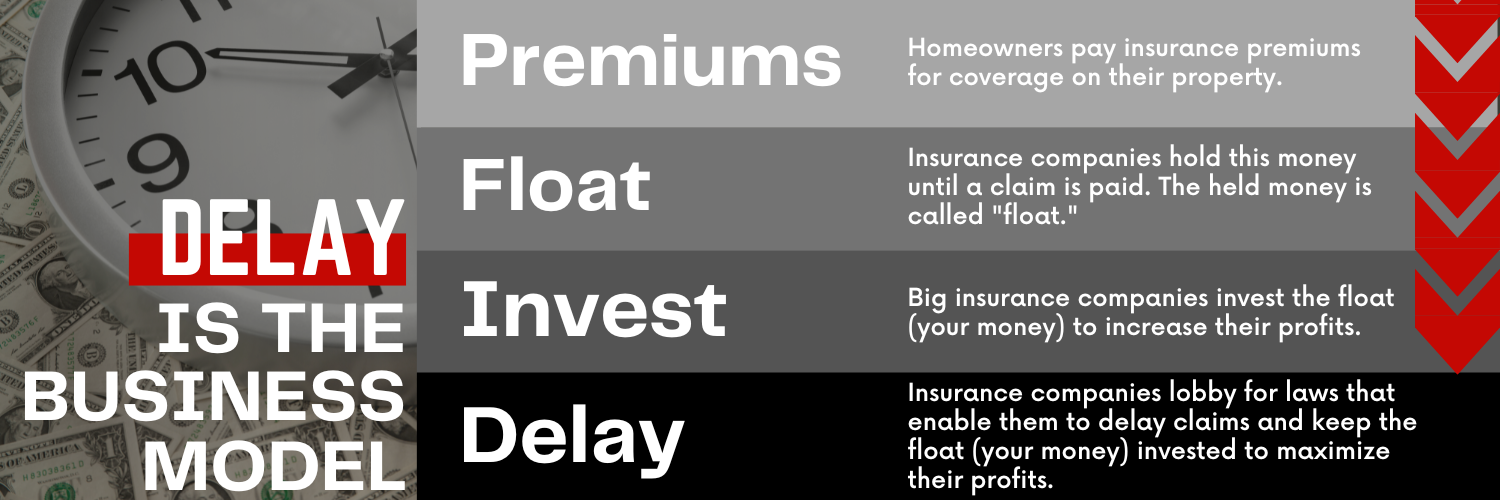

Everyone knows about insurance premiums and claims, the money brought in and paid out by insurance companies. But the insurance industry is all about "the float." To understand the business of insurance and why big insurance companies spend millions lobbying for bills that delay policyholders' claims, you need to understand float.

News that Berkshire Hathaway's operating earnings rose 12% from insurance profits made a big splash early this summer. What drove those profits? “Insurance investment income [for Geico] rose by 68% to $1.969 billion from $1.17 billion,” according to The Street. In short, they invested the float.

WHAT IS FLOAT?

Policyholders pay premiums every month to protect their homes and businesses. When their property is damaged, they file a claim, and the insurance company is expected to cover that loss.

The float is the money in the middle. It's the money received from premiums that insurance companies hold before a claim is paid. Insurance companies use delay tactics to extend that gap and increase their profits.

INVESTING THE FLOAT

Essentially, big insurance companies treat the premiums received from policyholders as interest-free loans that do not need to be repaid until they are forced to cover a claim. Insurers invest that money to increase their profits.

This is the secret behind much of Warren Buffett's success. He is the CEO of Berkshire Hathaway, which owns GEICO Insurance. Buffett says, “One reason we were attracted to the Property & Casualty [insurance] business" was that the "collect-now, pay-later model leaves property & casualty companies holding large sums [and] that insurers get to invest this float for their own benefit." And he has done just that. Buffett's company has outperformed the S&P 500's gains 153 times over since 1965.

INCENTIVE TO DELAY

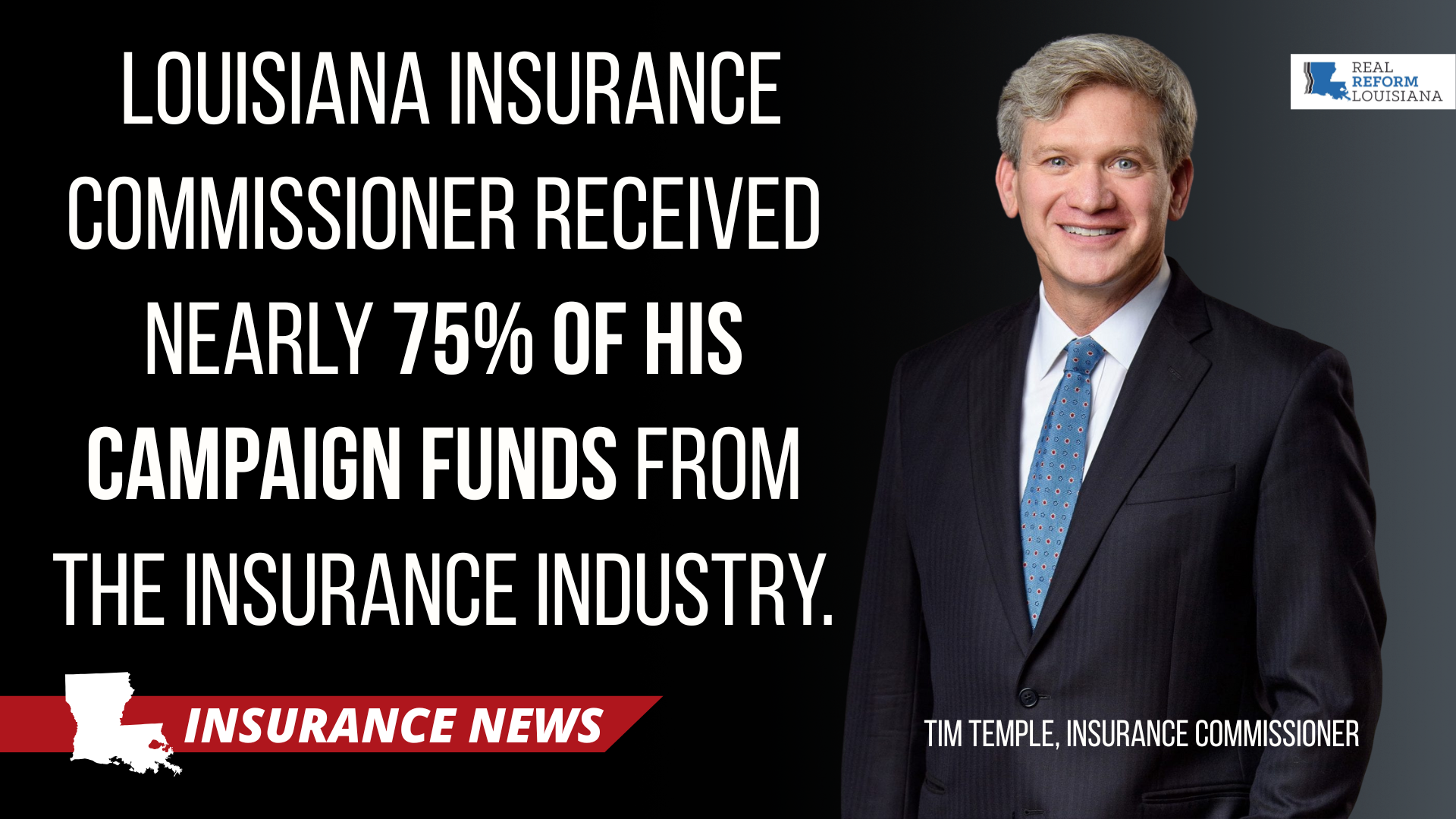

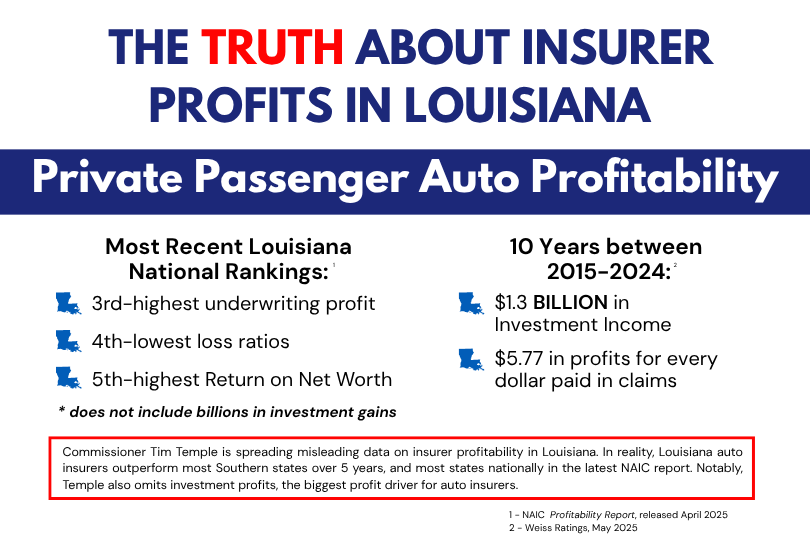

Investing the float is how big insurance companies make their profits. Unfortunately, this creates an incentive for them to cheat policyholders. Big insurance spends millions of dollars lobbying lawmakers for industry-friendly legislation that enables them to delay claims.

The business of insurance is investing. They write policies just to acquire funds that they can invest for their benefit. Moreover, big insurance wants to delay policyholders' claims to extend the life of their investment and pad their profits. Delay is their business model. It's corporate greed.